PineBridge Investments: Don’t overlook EM Debt in sustainable investment portfolios

PineBridge Investments: Don’t overlook EM Debt in sustainable investment portfolios

Strategies involving Emerging Markets, once viewed as incompatible with ESG investing, are now at the center of sustainable investment decisions.

By Jonathan Davis, Client Portfolio Manager Emerging Markets Fixed Income, PineBridge Investments

Sustainability issues are gaining increasing attention, resulting in changes to government regulations and becoming a major focus of corporate capital expenditures. This makes an in-depth analysis of sustainability risks essential when assessing the creditworthiness of fixed income investments over time. For large segments of the Emerging Markets (EM) corporate bond market, sustainability changes will be transformational, with significant investment implications.

The utilities sector, for example, has long been a defensive component of the EM corporate bond market, characterized by a predominance of stateowned entities, government support, and longterm contracts. Yet the sector also accounts for some of the highest levels of greenhouse gas emissions in the corporate bond market, which has led to seismic shifts within the sector as more utilities turn to bond markets to finance investments in renewable energy sources. Analysis of sustainability risk will help identify issuers with better longerterm credit trends. We can also expect markets to begin pricing material discounts for more sustainable utilities – a trend that will only increase as more investment capital becomes aligned with sustainability issues.

Until recently, a notion has persisted that EM was incompatible with sustainable investment. This notion was guided by misconceptions about corporate governance and the extent to which management cared about environmental and social risks, as well as concerns about the availability of ESG-related data. Where skeptics may have pointed to high levels of coal consumption in China and India as proof that EM assets could not fit within sustainable investment portfolios, more and more investors are embracing the role their capital can play in financing investment into renewable energy within the world’s largest countries.

The International Energy Agency (IEA) estimates that the world faces a funding gap of anywhere from $ 1 trillion to $ 4 trillion to achieve carbon neutrality by 20501 . Emerging markets will require much of the funding needed for the clean energy transition, as home to roughly 80% of the world’s population – a population that is younger and urbanizing more rapidly than in developed markets (DM) – and responsible for more than two thirds of the world’s carbon emissions2 . As such, we’ve quickly moved from an environment where EM fell outside the scope of sustainable investment to one in which EM investment strategies are at the center of sustainable investment decisions.

We’ve quickly moved from an environment where EM fell outside the scope of sustainable investment to one in which EM investment strategies are at the center of sustainable investment decisions.

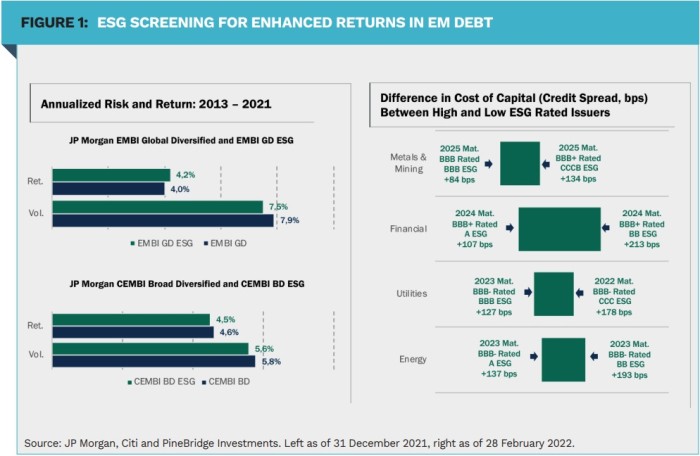

There is yet another critical benefit to EM corporate debt within a sustainable investment framework: specifically, the ability to access a wide range of risk and return potential. Among DM credit markets there is a relatively strong relationship between credit ratings and ESG ratings, meaning ESG-focused investment portfolios within DM credit markets are often constrained in their ability to source credit risk. Among EM corporate bond issuers, the relationship between credit ratings and ESG ratings is substantially weaker, due in large part to the sovereign rating cap maintained by credit rating agencies. As a result, investors can access the full risk and return potential of the market in sustainable EM corporate bond portfolios.

Responsible investing is not new. But the commitments of governments and corporations to address global climate change, technological advancement and a dramatic shift in demographics ensure that the future of investment management will likely be one in which sustainability assumes a central role. We are still at an early stage of that journey, with asset managers, asset owners, and regulators all working to define the role of sustainability and set targets and expectations to ensure the effectiveness of such strategies.

1] Source: The International Energy Agency, ‘Net Zero by 2050’ report, May 2021.

2] Source: IMF, Bloomberg, Worldometer as of 31 December 2021. Any opinions, projections, estimates, forecasts and forwardlooking statements presented herein are valid only as of the date of publication and are subject to change. For illustrative purposes only.

|

SUMMARY Emerging markets will require much of the estimated $ 1 to $ 4 trillion in funding needed to achieve net zero. As such, EM investment strategies are now at the center of sustainable investment decisions. Among EM corporate bond issuers, the relationship between credit ratings and ESG ratings is substantially weaker than in developed markets. As a result, investors can access the full risk and return potential of the market in sustainable EM corporate bond portfolios |