Monex: Pay particular attention to macroeconomic projections, Powell is unlikely to release much

Monex: Pay particular attention to macroeconomic projections, Powell is unlikely to release much

This is a brief preview frem Ima Sammani, FX Market Analyst at Monex Europe, at the Fed's policy meeting, taking place tomorrow.

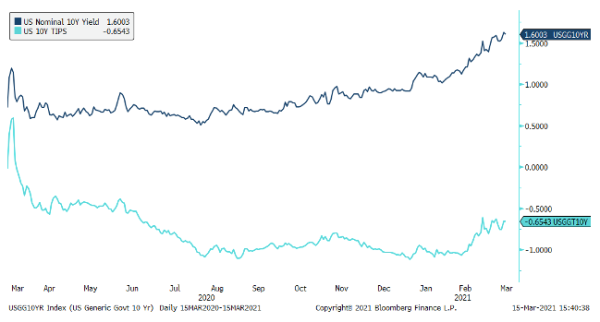

The March 17th FOMC meeting is likely to be one of the most important for Chair Powell in his tenure at the helm of the central bank, with many drawing comparisons with the task presented to his predecessor Bernanke back in 2013. However, despite its level of importance, the meeting doesn’t require a decision on policy measures by the FOMC beyond what they wish to do with the Supplementary Leverage Ratio (SLR) relief. Instead, the challenge is one of communications. Since the January meeting, the US yield curve has substantially steepened with the 10-year yield rising some 60bps to trade above the 1.6% handle. While most of the rise in back-end yields can be attributed to rising inflation expectations, real yields began to increase in late February along with expectations of rate hikes.

10-year yield rises largely due to an improved inflation outlook, but recently rate expectations began to rise too

Thus far, Fed officials have only given market participants glimpses of their stance on the rising and steepening of the yield curve. Meanwhile, markets are trying to price the reflationary environment under the Fed’s new Average Inflation Target (AIT), with little guidance as to what the parameters surrounding it truly are – how much is inflation allowed to overshoot 2%, how long is the averaging period, what is “substantial progress” in the labour market recovery? To date, the Fed’s guidance has been vague and centres on outcomes as opposed to time.

However, the market works differently and needs to price in expectations over specific time periods. Considering the developments since the January meeting, namely the $1.9trn fiscal stimulus package and rapid rate of vaccinations in the US, the emphasis is now on the Fed to give fixed income markets a bit more of a playbook. Without doing so, it risks a severe misunderstanding of the Fed’s new AIT and a premature tightening of financial conditions. We argue that the Summary of Economic Projections will be the best place for markets to look for guidance, with Jerome Powell likely to refrain from giving away too much in the press conference in order to maintain monetary policy flexibility. The signal cast by the Fed will not only give fixed income markets a more tangible understanding of the Fed’s reaction function, but will also be deterministic for the broad dollar in the months to come. Currencies like AUD and EUR remain vulnerable to a net hawkish meeting given the recent decisions by their central banks to increase QE and contain the rise in rates, while EM FX will feel the pinch of any bond market volatility.