MUFG Daily Snapshot – Olieprijs crasht – wie wil er nog olie?

FX Daily Snapshot Oil price weakness continues to highlight collapse in global demand.

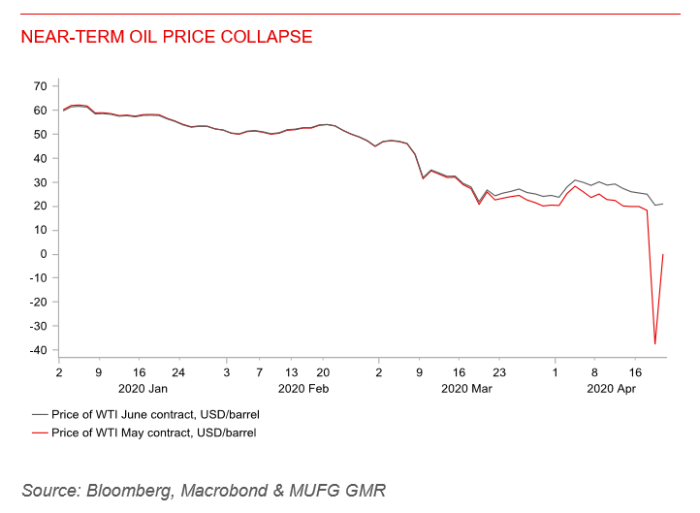

USD: Oil price collapse triggers bout of risk aversion

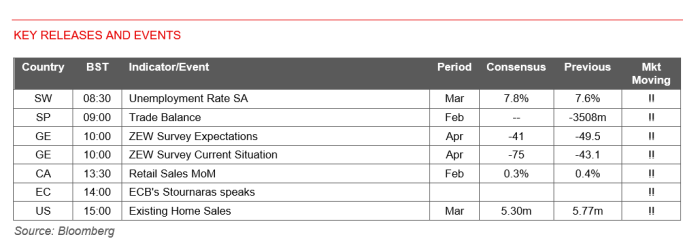

The US dollar has strengthened overnight supported by the return of more risk off trading conditions which has helped to lift the US dollar index back above the 100.00level. The late sell-off in the US equity market has extended into the Asian trading session alongside weakness in commodity prices. The Australian and New Zealand dollars have underperformed amongst G10 currencies. The bout of risk aversion has been mainly triggered by yesterday’s collapse in the price of oil which has further heightened concern over weak global demand. In a breath taking move, the price of the May WTI contract which is due to expire today settled yesterday at – USD37.63/barrel. Traders were left desperate to avoid having to take delivery of physical oil because of the lack of supply capacity. According to Bloomberg, the largest oil ETF, known as the US Oil Fund, which had accumulated a fifth of all outstanding May futures contracts, had rolled its position into the June contract last week. It has left the May contract more exposed to the forces of physical supply at the start of this week. Retail traders were then likely forced to liquidate positions.

Our Middle East analyst Ehsan Khoman expects the pain to continue until Congress acts to incentivise US oil producers to cut supply or the global lockdowns ease allowing demand to pick up. It has been reported over the past week that the Trump administration is “contemplating paying oil companies to leave their product in the ground”. The Department of Energy is reportedly drafting a plan that would pay companies to leave as much as 365 million barrels untapped by considering it part of the nation’s emergency stockpile but it faces opposition in Congress. Overnight President Trump stated that he wanted to add as much as 75 million barrels of oil to the Strategic Petroleum Reserve, and that he’ll consider blocking imports of crude from Saudi Arabia. The unfavourable developments should keep downward pressure on oil related currencies (click here) in the near-term.

NZD: Dovish RBNZ comments reinforce kiwi sell off The New Zealand dollar has been the worst performing G10 currency amidst more risk off trading conditions overnight which has resulted in the NZD/USD rate falling back below the 0.6000-level. The kiwi has also been hit more specifically by dovish comments from RBNZ Governor Adrian Orr. He stated that the RBNZ will be thinking about the need for additional stimulus at its May review. The RBNZ’s next policy meeting takes place on the 13th May. So far the RBNZ has lowered their key policy rate to 0.25%, and committed to total QE purchases of NZD33 billion. Governor Orr stated that negative rates are not ruled out but “aren’t the best tool we have” for the current situation. He sees negative rates as best for a low, long economic contraction. Instead, he believes that QE is a far more effective and efficient tool for dealing with the sharper shock from COVID-19, and left open the possibility that the QE programme could be extended further. He even said he was open minded on direct monetization of government debt.

The RBNZ’s increasingly dovish comments stand in contrast to recent RBA policy action. It has already helped the AUD/NZD rate rebound sharply over the past month after falling to parity in mid-March. The RBA has been slowing the pace of QE purchases as market conditions improve similar to the Fed. The Fed has halved the daily pace of US Treasury purchases this week to USD15 billion and slowed MBS purchases to USD10 billion from USD15 billion. Similarly, the RBA has slowed daily bond purchases to AUD0.5 billion. The RBA stated that daily operations are likely to be on a smaller scale in the near-term. Governor Lowe added overnight that he expects Australia’s economy to contract by 10% during the 1H 2020 and the unemployment rate to rise to around 10%, but is confident it will bounce back. The RBA’s QE purchases should not be confused with government financing.

GBP: Government support should help to dampen hit to UK labour market The release of the latest UK labour market report revealed jobless claims increased by 12.2k in March. It provides only a taster of what is likely to come in the months ahead when the number of unemployed is expected to surge higher. The OBR have forecast that the unemployment rate could jump to 10% from the latest reading of 4.0%. The government will be hoping though that their wage subsidy scheme will help to dampen the rise in the number of unemployed to “catastrophic” levels. Budget officials have reportedly calculated that over 8 million furloughed workers could claim under the government’s Job Retention Scheme this quarter.

The programme formally opened yesterday and allows companies to apply for government funding to pay 80% of the wages of furloughed employees, capped at GBP2.5k per month. In return, companies are obliged to rehire workers once the crisis has passed and lockdown is rescinded. It is currently set up to cover pay from the 1st March to 30th June, but can be extended. The OBR estimates it could cost about GBP42 billion over the first three months. If the scheme proves successful at dampening the rise in unemployment, it will help the UK economy to recover once the lockdown is eased and provide encouragement for a stronger pound further down the road.

The UK government is coming under increasing pressure to set out their plans to ease the lockdown. They have just extended the lockdown by a further three weeks until the 7th May. Press reports over the weekend though have strongly suggested that the UK government is considering a traffic light system. In the first phase, it could see the re-opening of small non-essential shops, services such as nurseries and hairdressers, and schools from the 11th May at the earliest but the public would still be urged to avoid non-essential travel. Former Chancellor Philip Hammond has called for a gradual reopening of the economy. He believes the country would need to focus on “coexisting with the virus rather than conquering it”.