AXA IM: Thorough research supports real impacts on biodiversity

AXA IM: Thorough research supports real impacts on biodiversity

How can in-depth research help investors find the companies providing innovative solutions to support biodiversity while avoiding companies where the impacts are less clear?

By Tom Atkinson, Portfolio Manager, AXA Investment Managers

Investors are realising that efforts aimed at halting and mitigating biodiversity loss are as crucial for safeguarding future sustainable growth as those aimed at tackling climate change. While these efforts are both necessary and positive for driving the flow of capital into sustainable investments, it’s important for investors to choose wisely if they want to achieve efficient and impactful results.

Seeing the wood for the trees

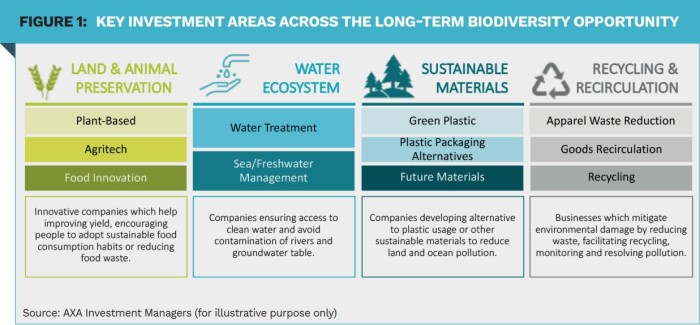

Active investment managers look for companies and industries where real, measurable, and sustainable impact is achievable. Key to this is identifying significant drivers of biodiversity loss and finding investable solutions. They scour for companies and industries where real, measurable, and sustainable impact is achievable through innovation.

Take land use, for example. By investing in companies that have the potential to mitigate the impact of inherently intense, but necessary, land use – such as the need to feed a growing global population via agriculture – we can promote efficiencies, innovations and best practices that could reduce the impact on the planet of large-scale food production.

Research also helps to identify opportunities that appear to support biodiversity on the surface but, on closer inspection, may not provide the level of truly positive action necessary to earn a place in an impact portfolio. For example, we closely examine everything from the supply chains, operations and related environmental factors, using our own impact analysis and ESG research and data, from both internal and external data providers, and this can sometimes provide surprising results.

One example of this need for caution has been our research into UK water utilities. A lot of good work has been undertaken within the industry to reinvest in the network and to upgrade infrastructure, but the sustainability profile of these companies is still challenging and therefore we have chosen not to hold these investments in our impactfocused biodiversity portfolio. Sewage leaking into rivers is a particular concern, as this is harmful for species health and abundance. It’s also bad for human health – it risks potential contamination to bathers, it can contaminate drinking water, and it introduces contaminants into the food chain through agricultural uses.

UK water utilities have a mixed track record on pollution. This is partly because the infrastructure is quite old, and partly due to logistical and financial limitations on their capacity to renovate aged facilities as quickly as they would like. Additionally, climate change is causing more intense rainfall, which can put further pressure on ageing water infrastructure.

There’s always a bigger fish

Intense land use and accompanying species loss caused by agriculture can make investors, looking to support biodiversity, sceptical about companies in related areas, such as agritech. Yet sophisticated, precision farming technology pioneered by firms, such as leading farming technology provider Deere, could help materially reduce the impact that food production has on the environment, while positively contributing to global food security. Technology that minimises fertiliser and pesticide use enables efficient food production while significantly reducing unnecessary contamination of the environment.

It’s crucial to critically examine all the risks and opportunities across a company’s operations and supply chains.

This potential for making a material impact compares favourably to the environmental credentials of aquaculture firms. MOWI, the world’s leading seafood company, is described in generally favourable terms by the World Benchmarking Alliance, which has placed it in second place on the Seafood Stewardship Index.

But while the company is admirably transparent around reporting its environmental footprint, ‘significant scope’ for improvement remains. Similarly, a high proportion of live fish escape from its farms, which has worrying implications for interbreeding or dominance of invasive species introduced into local ecosystems. That said, aquaculture has the potential to alleviate the pressure on land use from agriculture, highlighting the potential of sustainable aquaculture.

Check under the hood of every investment

When investing in companies that are making positive contributions towards biodiversity, it’s crucial to critically examine all the risks and opportunities across a company’s operations and supply chains. Sophisticated impact assessments should be employed, as well as comprehensive fundamental research alongside active engagement. This will allow to uncover promising opportunities, leverage investors’ position to drive positive change, and champion companies likely to have the strongest positive effect on the preservation of natural capital, while, of course, contributing to financial returns and the long-term investment goals of clients.

|

SUMMARY A variety of multi-sector opportunities exists within the biodiversity universe. Diligent analysis can help improve the likelihood that investors’ capital achieves real, positive impact. Some of the most innovative and necessary solutions to mitigate loss are found within intense land use industries, such as agriculture. |

|

Disclaimers This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/UE), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision. |