DNB: Dutch pension funds’ average funding ratio improved

DNB: Dutch pension funds’ average funding ratio improved

In the second quarter of 2022, Dutch pension funds saw their average funding ratio improve relative to the first quarter, as the value of their liabilities showed a steeper decline than their assets. Pension assets went down by €190 billion to €1,517 billion, while aggregate liabilities fell by €198 billion to €1,239 billion.

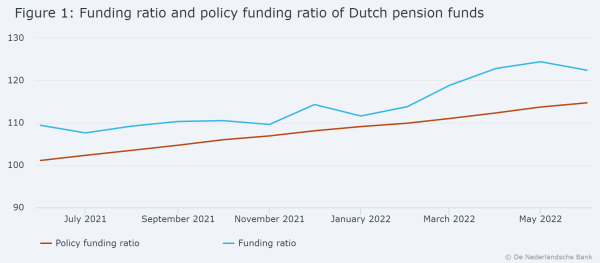

The Dutch pension sector’s average funding ratio came to 122.4%. This represents a 3.6 percentage point increase from the previous quarter (see Figure 1). It is now well above the figure for a year ago, which was 109.4%. The funding ratio reflects a pension fund’s current financial position, expressing the ratio between available assets and liabilities.

The policy funding rate came to 114.7%. This represents a 3.7 percentage point increase from the previous quarter. The policy funding ratio is the average of the funding ratios for the past twelve months. It increased because the funding ratios in the second quarter of 2022 were higher than those in the corresponding quarter of 2021.