Columbia Threadneedle: Failure to meet responsible investment expectations is deal breaker for professional investors

Columbia Threadneedle: Failure to meet responsible investment expectations is deal breaker for professional investors

Weakness in responsible investment (RI) is not being tolerated by professional investors, according to a 2021 client survey by Columbia Threadneedle Investments. According to the findings, RI forms an important part of the manager selection process (85%), with the majority (72%) of the institutional and wholesale investors surveyed saying that not meeting RI expectations is a “deal breaker” when considering asset managers that can help them meet their investment objectives.

Responsible investment is seen as more than just a dedicated investment strategy

According to the survey:

- Eighty-six per cent of investors agree that RI is a fiduciary requirement.

- The majority believe that it is key to pursuing financial outcomes in portfolios (77%).

- Almost all respondents (91%) agree that RI adds value and that it enables them to meet their own clients’ evolving preferences (89%).

- Investors also believe shareholder engagement leads to improved governance and sustainability outcomes in portfolios (91%).

- From a thematic perspective, global water (86%), climate change (83%) and biodiversity (77%) dominate investors’ interest.

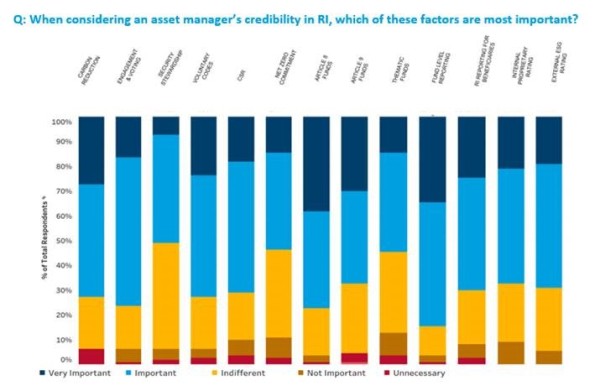

ESG fund level reporting provides most credibility for asset managers

When it comes to expectations and determining asset managers’ credibility in RI, a broad set of factors are considered important. Top of the list is fund-level reporting (85%) which includes a range of Environmental, Social and Governance (ESG) metrics. Also seen as key are a proven record in conducting effective company engagement and voting (76%), being a signatory of key voluntary codes & industry standards (73%) and the ability to support with carbon reduction within portfolios (73%).

Investors are prepared to divest from Article 6 funds

Evidently, managing dedicated RI strategies also plays a key role in determining asset manager credibility. In regions where the EU’s Sustainable Finance Disclosure Regulation (SFDR) applies, this predominantly means offering Article 8 and 9 funds. The survey respondents expect their investment allocations to reflect this:

- Only one third plan to hold investments in Article 6 funds by the end of 2022.

- Almost three quarters of respondents would support a conversion from their existing Article 6 funds to Article 8 or 9. Indeed, nearly one in two are willing to divest if asset managers do not convert them. In contrast, only 8% of respondents would object to such a conversion, while 19% said they did not know.

- There is particularly strong demand for Article 8 equity (86%) and fixed income funds (81%), with less interest in multi-asset (70%) or exclusion-based equivalents (52%). This picture is similar when it comes to Article 9 funds.

Michaela Collet Jackson, Head of Distribution, EMEA, at Columbia Threadneedle Investments, commented on the results: “As a large global asset management firm, we recognise the responsibility and opportunity we have in driving positive change through our activities and making our own contribution to a sustainable future. Our survey shows just how important responsible investment has become in serving client needs. It’s clear that professional investors will now avoid – or even divest from – asset managers that are not meeting their RI expectations, be it by way of product offering, investment approach or client reporting. This sends a very loud message.”

Professional investors are also increasingly seeing their own RI integration as a corporate priority. A third of respondents were already well advanced in integrating RI within their business (defined as between 75% to 100% integrated), with 80% expecting to be there by the end of 2022.

Michaela Collet Jackson continued: “Responsible investment sits at the heart of Columbia Threadneedle’s corporate and client agenda. With the acquisition of BMO's European asset management business now complete, we can offer a market-leading RI capability based on creating value through research intensity, driving real-world change through active ownership, and partnering with clients to deliver innovative RI solutions. I thank our clients for taking part in our survey and look forward to working together to support their evolving RI objectives.”