Harry Geels: Who is going to buy all the American debt now?

Harry Geels: Who is going to buy all the American debt now?

This column was originally written in Dutch. This is an English translation.

By Harry Geels

The US national debt has skyrocketed to over $34 trillion. But who is buying up all this debt? Traditional buyers, such as China and Japan, are increasingly pulling out. Other buyers are stepping in, but they are not a good sign for the long-term strength of the dollar.

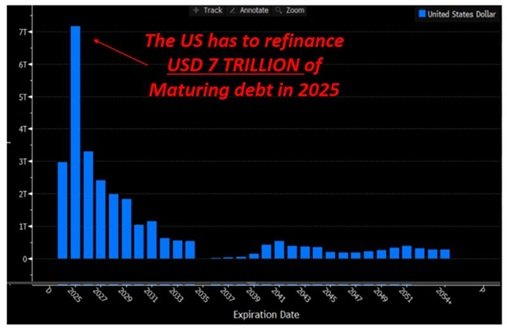

The US national debt continues to rise. It currently stands at $34 trillion, which is around 120% of GDP. The US government faces three other challenges. First, partly as a result of the trade war, the Chinese are buying fewer US government bonds. Secondly, the US has generally financed itself on a short-term basis, particularly during the era of former Fed chair Janet Yellen, partly due to the high demand for short-term money. This year, no less than $7 trillion of debt will have to be rolled over (see Figure 1).

Figure 1: US government refinancing requirements in trillions of dollars

Source: Alfonso Peccatiello

Moody's was the last of the three major rating agencies to downgrade the US government (to Aa1). In early May, the Trump administration adopted a somewhat curious plan entitled “One Big Beautiful Bill Act”, mainly involving fiscal stimulus, in the hope that even more economic growth is the solution: more growth, more revenue for the government. But it's not that simple. The government bonds have to be bought. Moreover, interest payments as a percentage of tax revenues are rising sharply (see Figure 2), to almost 25%!

Figure 2: Net interest payments on US government debt as a percentage of tax revenues

Source: Bloomberg/Macrobond/via Ryan Lemand

The Fed as silent buyer: ‘stealth QE’

The debts are now being bought up by other parties, which feels like a ‘quick fix’. Recently, the Fed bought more than $43 billion worth of Treasuries in less than a week, which were mainly put on the market by the Chinese monetary authorities. This is a form of monetary financing hidden behind the scenes. Officially, the Fed is engaged in Quantitative Tightening (QT), but the big question is whether this is still the case. Monetary financing is a sign of weakness, especially for currencies, in this case the dollar.

US banks as a stopgap solution

US banks have recently increased their holdings of government bonds significantly. In addition, the US Treasury is considering reforms to the Supplementary Leverage Ratio (SLR), a capital requirement for banks. Excluding government bonds from this ratio would encourage banks to hold more government bonds. Critics point out that this would make banks more vulnerable to shocks in the bond market, as well as increasingly becoming an extension of the government.

Stablecoins and crypto: new buyers, new risks

Stablecoin issuers such as Tether (USDT) have emerged as significant buyers of US government bonds. In 2024, for example, Tether purchased $33.1 billion in Treasuries (to ensure confidence and stability). This trend underscores the growing influence of digital currencies on traditional financial markets. But there is also a danger here: what if confidence in stablecoins suddenly disappears? There is also a paradox: crypto, intended as an alternative to fiat money, is now becoming a pillar of support for the dollar empire.

Other buyers

US households and money market funds have also become increasingly important players in the government bond market. Households have increased their investments in government bonds to around $2.75 trillion, a 5.5-fold increase since the end of 2021. Money market funds currently hold around $2.4 trillion in US government bonds. These shifts point to broader (more positive) domestic demand for government bonds amid changing market conditions.

Endgame: dollar subject to erosion?

If domestic players (Fed, banks, crypto) have to take over the role of foreign buyers, this is not a sign of strength, but of dependence. The dollar may remain dominant for some time, but its foundations are crumbling. What is helping the dollar for the time being is that the other major currencies also have their issues. It's a bit like the story of the lame and the blind. The euro system has structural flaws (“one size does not fit all”), the renminbi is still heavily regulated, and the yen has a debt problem similar to that of the US.

Europe is (opportunistically) seizing the opportunity to further complete the eurozone. Suddenly, we are seeing calls for eurobonds, which are necessary to complete the monetary union. The big question now is how long the US will be able to finance itself. Whatever the currency game looks like in the future, one conclusion is crystal clear: the value of the major currencies is under pressure, driving investors towards other types of investments such as equities (in particular), real estate, precious metals and, for as long as it lasts, cryptocurrencies.

This article is a personal opinion piece by Harry Geels