Ostrum AM: Hold-to-maturity credit investing in the spotlight

Ostrum AM: Hold-to-maturity credit investing in the spotlight

What are the merits of hold-to-maturity strategies? And are they attractive in the current rate environment? We take a look with Philippe Berthelot, CIO Credit & Money Market Management at Ostrum Asset Management, an affiliate of Natixis.

By our editorial team

Why a hold-to-maturity (HTM) strategy on the credit market?

‘A HTM strategy aims at holding securities in the portfolio until their maturity. The main characteristic is to have a maturity date known in advance and to offer visibility on the yield (excluding default). It is a transparent and quite straightforward strategy that maximises the portfolio’s gross yield to maturity relative to its investment objective and diversification guidelines, taking advantage of a favourable market environment at the time of investment.

The main challenge is to identify the best entry points to set up a portfolio of robust issuers. It aims at achieving an advantageous risk-return profile, with the highest carry seen for more than 10 years, while maintaining moderate volatility.

Issuers are monitored on an ongoing basis during the asset’s lifespan to guarantee the quality of financial and non-financial features ensuring that the investment is still a good opportunity. At maturity date, if there has been no default, issues are redeemed at par, and investors get back their capital plus the return accumulated during the life of the product.

This strategy represents a valid means of capturing the current market conditions, while also benefitting from an investment which becomes less exposed to uncertainty and market volatility.

For investors, this strategy represents a valid means of capturing the current market conditions, while also benefitting from an investment which becomes less exposed to uncertainty and market volatility, and also interest rate risk, as the final maturity of the security is reached.

Investors benefit from our hold-tomaturity know-how. We mainly manage bespoke solutions for investors such as private banks, insurers, corporates and institutional investors in Europe, Asia et cetera. Our hold-to-maturity strategies can be managed with ESG criteria and objectives, enabling them to be classified SFDR article 8.’

Why invest in an SRI credit HTM strategy now?

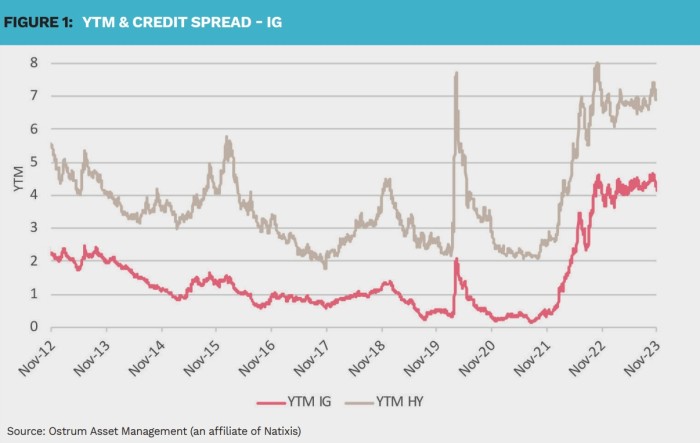

‘2023 is continuing its positive momentum for the credit market. Among European bonds, absolute yields have reached their highest levels compared to the past 10 years. We are close to 4.5% in the euro investment grade segment and close to 7.5% in the euro high yield market. The eurozone avoided recession, but growth remained sluggish at the turn of the year. According to our analysis, fundamentals remain solid for investment grade issuers and default rates are still well below their historical average for high yield. Lastly, central banks are at the end of the rate hike cycle. This situation remains beneficial for the credit market.

Fundamentals remain solid for investment grade issuers.

In addition, companies have robust balance sheets. Earnings published by European companies during the last reporting season were broadly in line with expectations. These latest healthy results are due chiefly to companies’ capacity to mitigate the impact of higher commodities and energy costs, for the time being. Over the next few months, the economic situation could impact companies’ credit quality, but only slightly, due to their currently robust balance sheets. Over the short and medium term, we believe that most of the companies we cover in our investment universe will be able to cope with a possible downturn in the economic environment. Lastly, the materiality of ESG issues on credit quality is the other key factor that we are integrating into our credit analysis. Regulations and decarbonation objectives within our economies are forcing companies to act with greater transparency. This move enables material non-financial criteria to be taken further into consideration, which provides pertinent information regarding issuers’ risk profiles and returns on bonds. This environment provides genuine opportunities to invest in credit, particularly via hold-to-maturity strategies.’

Is the HTM strategy still attractive in 2024?

‘The current environment provides genuine opportunities to invest in credit, particularly via hold-to-maturity strategies. This remains a means of capturing attractive yields ahead of the market’s expected fall in the ECB’s deposit rate in the second half of 2024.

For 2024, the yield curve should also steepen, which will allow to seek more yield on slightly longer maturities, 4 to 5 years. In terms of ratings, ‘BBs’ could be a good opportunity with an attractive yield return and a large number of issuers to ensure good diversification and high selection. Currently the ICE Bofa BB High Yield Index offers a gross yield of 6.3%.

A well as diversification, high selection is key. It means that an asset manager with strong resources in terms of portfolio managers or either credit analysts will help to find and capture the most promising financial and sustainable opportunities over the strategy’s maturity horizon.’

|

SUMMARY A hold-to-maturity strategy aims at holding bonds until their maturity date. It allows visibility on the maturity date (shrinking duration risk) and the achievement of returns (but with a default risk). It has low transaction costs. Strong convictions and active portfolio management are key to selecting issuers and properly diversifying the portfolio. The credit market is attractive: resilient companies, yields at their highest for more than 10 years. |

|

Disclaimer Main fund risks: capital loss, discretionary management, interest rates, credit, counterparty, sustainability risks. Ostrum Asset Management: Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 50 938 997 €. Trade register n°525 192 753 Paris – VAT: FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris. |