JP Morgan AM: Corporate refinancing costs are on the rise

JP Morgan AM: Corporate refinancing costs are on the rise

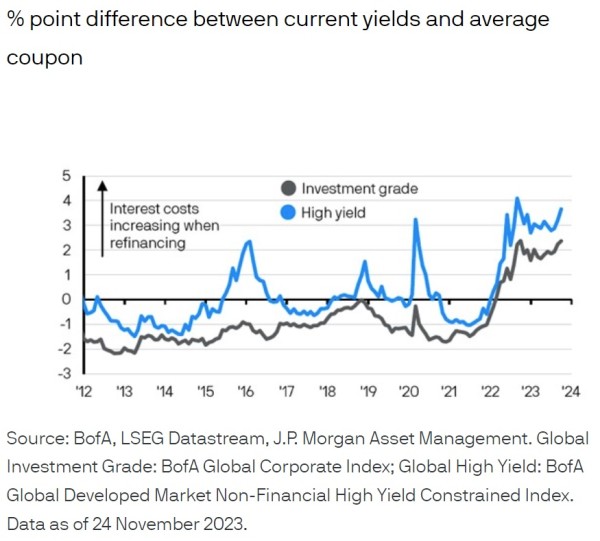

Through 2023, both investment grade and high yield bond spreads have remained contained, thanks to relatively resilient activity and low refinancing needs. However, in 2024 refinancing needs will pick up.

Given the gap between the amount corporates pay on existing debt (the average coupon) and what they must pay on new debt (current yields), these refinancing needs will be expensive, potentially impacting business spending in the coming year.

The situation is likely to be more problematic for high yield corporates given they will face a larger jump in interest costs when issuing new debt. This supports our preference for investment grade debt over high yield, where total returns could also benefit from higher rate sensitivity if government bond yields start to fall.