JP Morgan: Falling profits could lead to US job losses

JP Morgan: Falling profits could lead to US job losses

Markets have grown more optimistic in recent months. With the immediate growth risks from the debt ceiling and regional banking crisis in the rear-view mirror, investors increasingly see recession as a 2024 issue, and some expect the US to avoid it altogether.

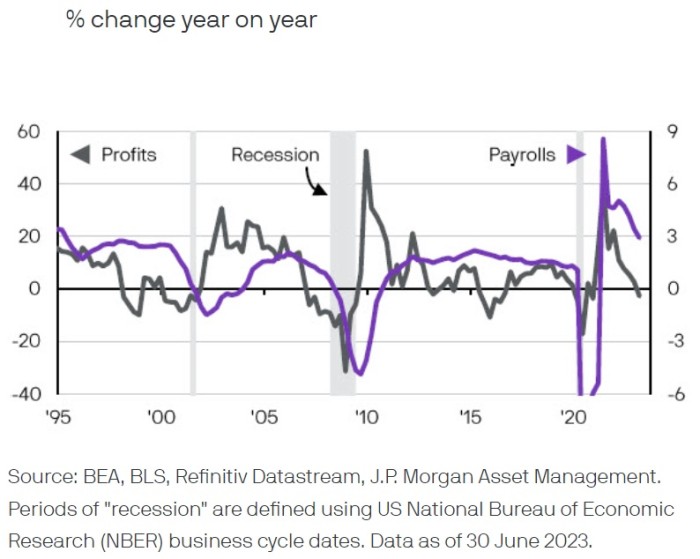

A key driver of this view is labour market resilience, but history suggests that this is a lagging indicator. As this chart from our Mid-Year Investment Outlook shows, when corporate profits fall, job losses often follow. Corporate profits are now falling and the full impact of central bank tightening is probably yet to be felt by the economy. While it's possible that labour hoarding could mute this relationship somewhat this time around, we think there's a risk that the market may currently be pricing in a scenario that is 'Too good to be true' (the title of our Mid-Year Investment Outlook).