Janus Henderson: Soft or hard landing - does it matter for investment grade bonds?

Portfolio Managers James Briggs and Tim Winstone look back at previous Eurozone economic downturns for their impact on investment grade corporate bonds and whether parallels exist with today.

|

Key takeaways

|

Soft or hard? That’s the dilemma facing markets and we’re not talking about cheese. Can central banks engineer a soft landing for the economy or will they provoke a hard landing with a deep recession? We take a look at previous economic downturns in the Eurozone and whether there might be lessons for today’s euro investment grade (IG) corporate bond market.

During the last 25 years the Eurozone has had four contraction/recessionary episodes, as represented by periods of negative quarterly real gross domestic product (GDP) growth. The automatic assumption might be that holding government bonds over corporate bonds would be a good strategy in a period of economic weakness. History suggests that is only true in hard landings.

The four eurozone economic contractions are:

- 2003 Iraq War (Q1 2003 short contraction)

- 2008/9 Global Financial Crisis (Q2 2008 to Q1 2009 deep recession)

- 2011/13 Eurozone Debt Crisis (Q4 2011 to Q1 2013 protracted shallow recession)

- 2020 COVID Pandemic (Q1 2020 to Q4 2020 V-shaped recession)

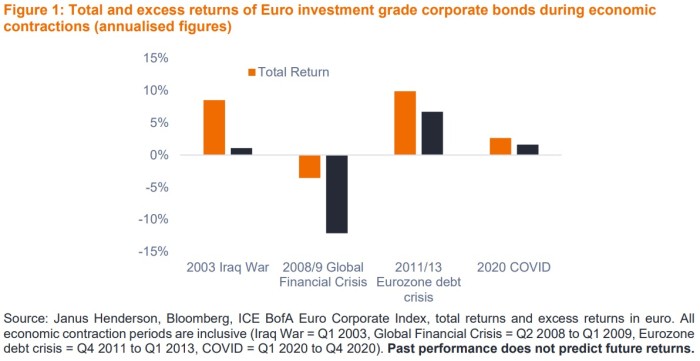

The ICE BofA Euro Corporate Index is a basket of Euro investment grade corporate bonds. Returns data is available for both total return (combined income and capital movements) and excess returns. The excess return isolates the portion of performance that is attributed solely to credit and is equal to the corporate bond(s) total return minus the total return on a risk-matched basket of government bonds. It essentially displays the excess return on an index that comes from the additional yield that corporate bonds accrue over government bonds of the same maturity and the effect of any change in credit spreads over the period.

Figure 1 shows that in three out of the four periods, holding investment grade corporate bonds was more rewarding than holding government bonds. Incidentally, investment grade bonds also outperformed equities (as represented by the MSCI Europe ex UK Total Return Index) in three out of the four periods (the exception being the 2011-13 debt crisis).1

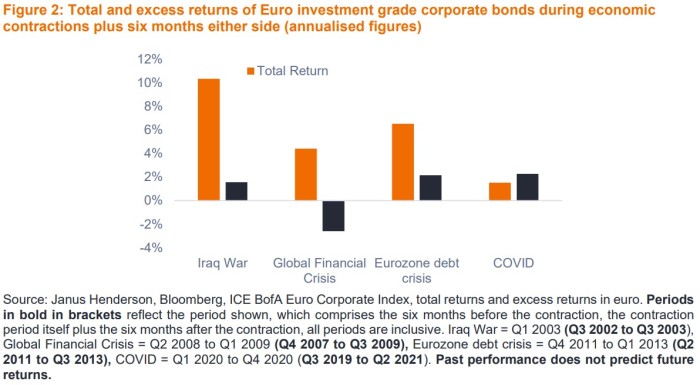

To correct for the fact that recessions do not just start and finish at the same time for all companies, i.e. some corporates will be affected earlier or later by economic weakness, in Figure 2 we expanded the period around the contractions to cover the preceding six months and the following six months. This turns total return positive in all the longer periods and tends to soften the extremes of excess return, i.e. lowers strong positive excess return and reduces negative excess return.

Given the uncertainty in the market about whether we will experience a hard or soft landing, the previous episodes are instructive. They reveal that it has historically made more sense to own investment grade corporate bonds over government bonds in all but the most severe economic contractions.

Accounting for differences

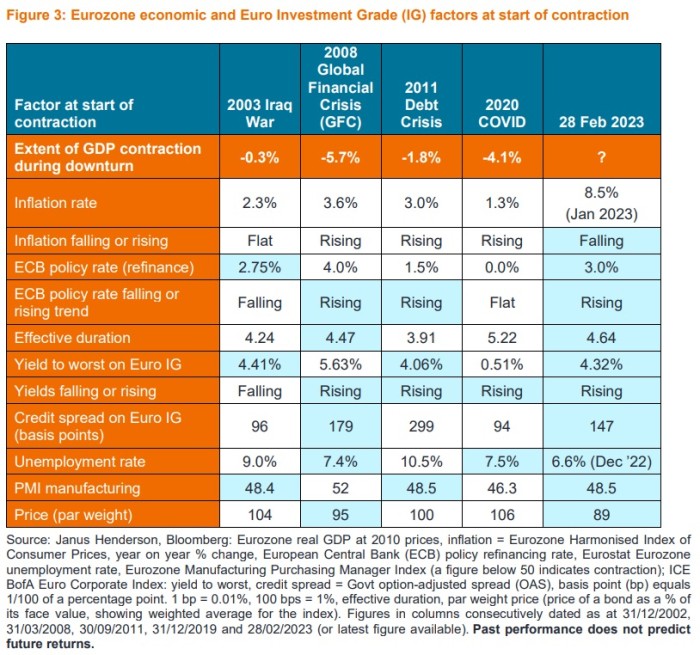

Of course, each of the four contractionary periods was different. But that can be helpful. We can look for similarities and differences among past contractions compared with today. In the table below we have colour coded green where factors are similar to today.

At first glance it looks disparate, but we should expect that as today’s environment is not a perfect match with any of the past contractions. If it were, investing might be a lot easier. The clearest distinction is inflation. In all previous episodes it was either flat or rising. Today it has rolled over and is coming down from a peak but the recent peak was much higher than at the start of previous economic downturns. How quickly it subsides will affect central bank policymaking so it remains a key variable for interest rate risk.

The colour coding in the table ominously has the most commonalities with the 2008 Global Financial Crisis (GFC) recession. Recall this was the downturn that resulted in negative excess return. Today’s yield and spread are below the levels at the start of 2008, which marries with our view that today’s market warrants some caution as it is not pricing in a severe recession. Despite the geopolitical risks emanating from Russia/Ukraine, however, we do not see the same systemic risk within the financial system that existed within the banking sector pre-GFC. Today, the banking sector is better capitalised and the coming downturn in our view is a more traditional economic downturn focused on consumer/corporate retrenchment, which ought to be less severe than a financial crisis.

Today’s yields and spreads are similar or higher than shallow recessions, potentially justifying current market pricing if the economy achieves a soft landing or shallow contraction. Another notable difference is that prices today are well below par values, creating a helpful pull to par. Judging against these parameters, Euro investment grade corporate bonds may be fairly priced for a shallow downturn and potentially offer value if the economy could avoid a recession altogether. Much will rest on how quickly inflation can recede and the response of central banks.

1 Source: Janus Henderson, Bloomberg, MSCI Europe ex UK, ICE BofA Euro Corporate Index, total returns in USD. Periods as per Figure 1.

|

James Briggs, ACA, CAFA – Portfolio Manager James Briggs is a Corporate Credit Portfolio Manager at Janus Henderson Investors responsible for the Global Investment Grade, Sterling Investment Grade, Buy and Maintain and UK Cautious Managed strategies. James joined Henderson in 2005 as a credit analyst and was named a portfolio manager in 2010. Prior to this, he was a credit analyst with BlueBay Asset Management and a high-yield analyst with Invesco Asset Management. James graduated with a BA degree (Hons) in philosophy from University College London. He is a member of the Institute of Chartered Accountants in England and Wales and holds the Chartered Financial Analyst designation. He has 25 years of financial industry experience |

|

Tim Winstone, CFA – Portfolio Manager Tim Winstone is a Corporate Credit Portfolio Manager at Janus Henderson Investors, a position he has held since joining Henderson in 2015. Tim comanages the European Investment Grade, Global Investment Grade, European High Yield, Global High Yield and Global Responsible Managed strategies. Prior to Henderson, he was an executive director, senior fixed income portfolio manager and part of the global credit team at UBS Global Asset Management. He began his career as a portfolio assistant at Thesis Asset Management and has worked in global credit since 2004. Tim earned a BSc degree (Hons) in mathematics from the University of Bristol. He holds the Chartered Financial Analyst designation and the Investment Management Certificate and passed the Regulation and Compliance unit of the CISI Diploma. He has 20 years of financial industry experience. |

|

Important information The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value. Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency. Issued in Europe by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes. Outside of the US: For use only by institutional, professional, qualified and sophisticated investors, qualified distributors, wholesale investors and wholesale clients as defined by the applicable jurisdiction. Not for public viewing or distribution. Marketing Communication. Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc. |