Alger: Drowning in debt?

Alger: Drowning in debt?

This is a piece written by Alger, a La Française partner firm. La Française AM Finance Services, in accordance with the terms of an agreement signed with Alger Management, Ltd, is a distributor of the Alger SICAV in Europe.

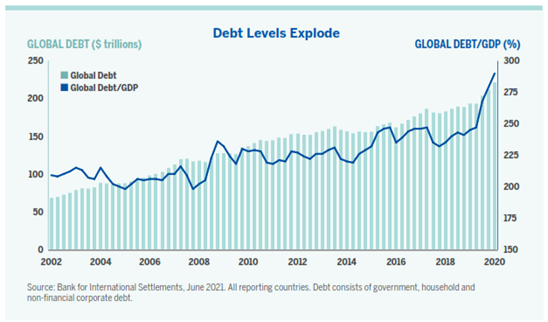

The huge fiscal stimulus in response to the COVID-19 pandemic has caused the already massive global debt load to surge. Will the global economy drown under the ever-rising tide of debt or can it tread water?

Recently released data shows that global debt soared 15% last year to a record $221 trillion or 290% of global GDP. Most of the $28 trillion increase was due to a 25% surge in government debt.

However, low interest rates have kept the cost to service debt relatively low. Even in the U.S., where interest rates are higher than in most developed economies, private sector debt service relative to income is only 14.2% compared to the 20-year average of 15.6%. Additionally, the Congressional Budget Office estimates that the interest on the federal debt will equate to 1.4% of GDP this year, lower than it was 15 years ago.

Although U.S. interest payments at both the federal and private sectors are not yet at levels where they take up disproportionate shares of our resources, we believe something will have to change in the next couple of decades so that the trajectory of the debt load does not continue unabated.

Notwithstanding the very fast growth the economy may experience this year, we believe this debt issue implies slower real economic growth over the long run which may put a premium on the companies able to generate their own secular growth. These companies could potentially include businesses involved in solar energy, online betting, e-commerce, cloud computing, streaming media, artificial intelligence and novel medical treatments.