J.P. Morgan: Significant uncertainty in US inflation forecasts

J.P. Morgan: Significant uncertainty in US inflation forecasts

The rise in US economic growth and inflation has been well flagged by markets and economists but uncertainty remains as to the persistence of these pickups.

A successful vaccine rollout is enabling a reopening of the economy and the combination of excess household savings and fiscal stimulus means there is plenty of fuel for a spectacular rebound in consumption. Indeed, the US economy grew at an annualised rate of 6.4% in the first quarter, and this pace is set to accelerate. Our latest article, “It’s getting hot in here: Growth and inflation are heating up,” examines these factors and the economic and market implications. The extent to which strong growth feeds through into persistent price increases remains to be seen, but signs of persistent inflationary pressures could push Treasury yields higher and further drive a rotation from growth to value stocks.

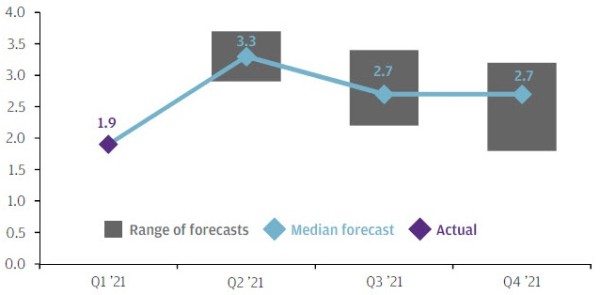

US headline CPI forecasts, % change year on year

Source: Bloomberg. J.P. Morgan Asset Management. CPI is consumer price index. Forecasts shown are for the quarterly average of CPI inflation. Data as of 30 April 2021.