Harry Geels: Three causes of the worrying trend of food inflation

Harry Geels: Three causes of the worrying trend of food inflation

This column was originally written in Dutch. This is an English translation.

By Harry Geels

Globally, since 2020, we have been spending an increasingly large part of our income on food. This has roughly three structural causes: stricter eco-standards, a growing world population, and oligarchies in the food industry. We can therefore add a new inflation term: food inflation.

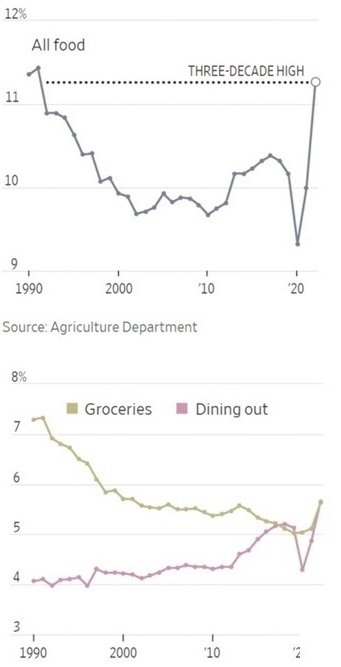

The US Agriculture Department recently announced that the percentage of disposable income spent on food reached a 30-year record. The increase started somewhere in 2010, but suffered an intermediate dip when the corona crisis was at its peak and we could no longer eat out. Since then, the share of our income that we spend on food has increased rapidly. Rising food prices are not limited to the US. Consumers are also affected by this in Europe and especially in emerging markets.

Figure 1: Expenditure on food as a percentage of disposable income

Source: The Daily Shot, March 1, 2024

In addition to a time-bound cause of rising food prices, namely the war in Ukraine and the associated increase in energy prices (food consists largely of energy), there are more structural causes. It is particularly worrying for low-income groups, who have to spend a relatively large part of their income on food, and for emerging markets, which have to import a relatively large amount of food. According to rating agency S&P, investors would underestimate the 'global food shock' for certain emerging markets. Let's take a closer look at the more structural causes.

1) Higher eco standards

Individual food prices are quite cyclical and volatile, which is why they are not included in core inflation figures. However, this is misleading. Firstly, because food makes up a large part of the consumer's spending basket. Secondly, because the average of all major food prices is fairly stable over time. And that average will probably only increase further in the coming years, because more and more attention is being paid to 'true pricing' and higher environmental standards are being demanded of farmers.

2) Growing world population

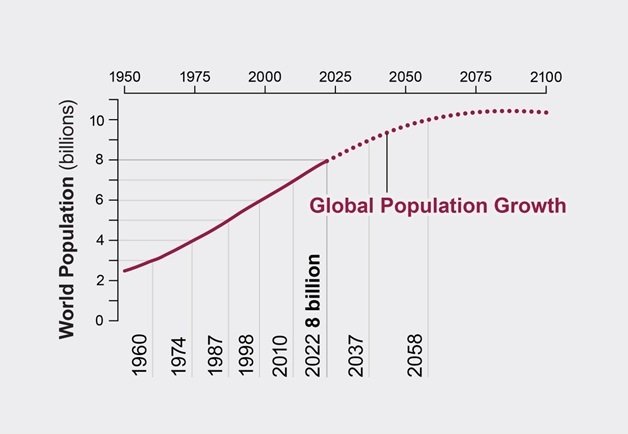

The second structural cause concerns the demand for food, which will continue to rise due to the growing world population until approximately 2075. And it's not just the number of people that is increasing. It is also likely that in emerging markets people are becoming richer on average and are slowly eating more protein-rich and luxurious foods. A meta-study shows that total global food demand is expected to increase by 35% to 56% between 2010 and 2050. Moreover, the study shows that the population at risk of going hungry is expected to change by -91% to +8% over the same period).

Figure 2: World population growth

Source: Scientific American

3) Oligopolies in the food industry

According to research by The Guardian, approximately 80% of the most important foodstuffs we buy every day are (indirectly) owned by a few large food groups. Almost all major supermarket products are owned by oligopolies. They have price power, which has also been demonstrated during the recent wave of inflation, when the best-known food groups achieved record profits. An unequal power struggle has arisen between suppliers and buyers of food. Consolidations – i.e. more price power or profit inflation – are more likely than splits in the coming years.

Figure 3: The Magnificent 10 food conglomerates

Source: The Defender

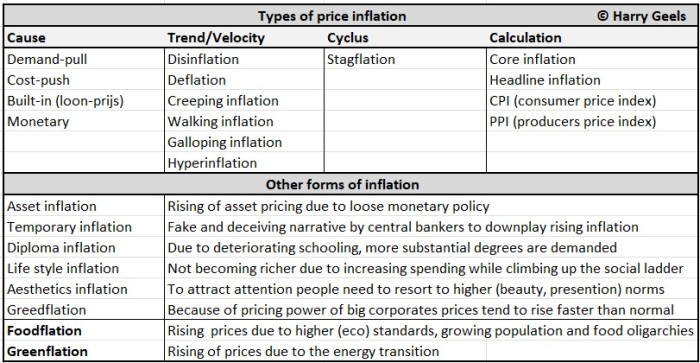

A new addition to the inflation family

Earlier I called in a column to categorize the many forms of inflation according to Cause, Trend/speed, Cycle and Calculation. Other forms of inflation than price inflation were described. Many social phenomena are subject to loss of value and it is nowadays popular to use the word inflation for this. Since the publication of the previous column, two forms of inflation have been added: foodflation and greenflation. The latter will also contribute structurally to inflation. Perhaps more about that another time.

Finally, does the consumer not only want to suffer from rising food prices, but also want to benefit from it? It is likely that a 'basket of shares from the food industry' in the investment portfolio will offer some relief.

This article contains a personal opinion from Harry Geels