State Street SPDR ETFs: Putting the best foot forward in EMD

State Street SPDR ETFs: Putting the best foot forward in EMD

During the first four months of the year Emerging Market Debt saw USD 72 billion of inflows. The high yield offered and relatively low correlation to Treasuries have underpinned the appeal of EM debt.

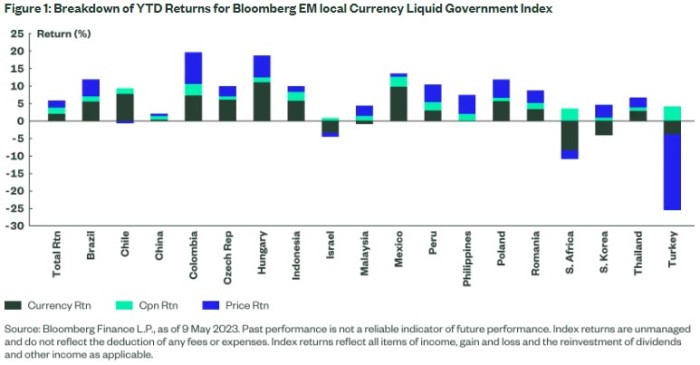

As Figure 1 shows, most countries have seen positive returns with Brazil, Columbia, Czech Republic, Hungary, Indonesia, Mexico, Peru and Poland all returning in excess of 10% year to date. Three countries have weighed on performance: Israel, South Africa and Turkey, much of which has been the result of political issues.

Jason Simpson, Senior Fixed Income Strategist at State Street SPDR ETfs, states resilience in EM should have been helped by relatively high levels of conviction that returns from EM debt can remain strong in the coming months. Breaking down the stream of returns into the bond, forex and coupon components, all three have the potential to continue to deliver.

- We expect bond returns to be the main deriver of returns over the coming 6 months. Easing inflation pressures and the eventual top to US rates may give EM central banks confidence to start cutting rates and not be concerned about a slide in their currencies. Real rates, in many of the LatAm countries in particular, are high and will need to come down.

- Coupon returns are running at a 4.9% annualised rate so far in 2023. With 4 out of the 18 countries in the index having a yield to maturity of greater than 10%, this rate is likely to rise in the immediate future as the coupon on new bonds that enter the index reflects the higher current market yields.

- The long-term model of fair value run by State Street Global Advisors estimates the basket of currencies that make up the Bloomberg EM Local Currency Liquid Government Index to be close to 10% undervalued versus the USD (as at the end of April). In short, there remains plenty of scope for USD depreciation to continue supporting returns. However, if EM central banks do start to ease monetary policy, returns from a weaker USD are unlikely to be as positive as they have been during the past 6 months.”