SSGA-SPDR: Europe small caps - Will investments lead the second leg of the recovery?

SSGA-SPDR: Europe small caps - Will investments lead the second leg of the recovery?

The current combination of economic recovery and tightening (but still easy) monetary policy could allow investors to extract value through small cap strategies, which when compared to their large cap counterparts are more cyclical and domestic in nature.

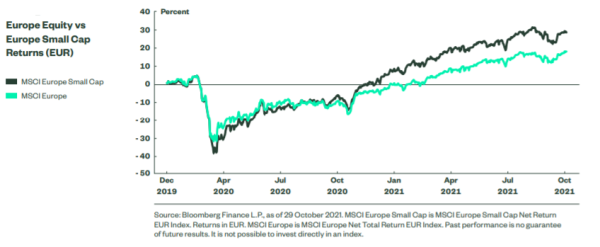

To be sure, investing in a single small company brings higher risk as disclosures and analyst coverage are often limited. However, index strategies with thousands of components provide a way to diversify away from some of these risks while still enjoying the size premia. Smaller stocks suffered disproportionately from the negative impacts of the global pandemic but have bounced back firmly since vaccine development.

The backdrop for European equities remains supportive given their undemanding valuation, appealing spreads to local bonds and solid COVID management across the continent. MSCI Europe Small Cap exposure and its value-weighted version allow investors to gain exposure toward more cyclical and domestic companies.

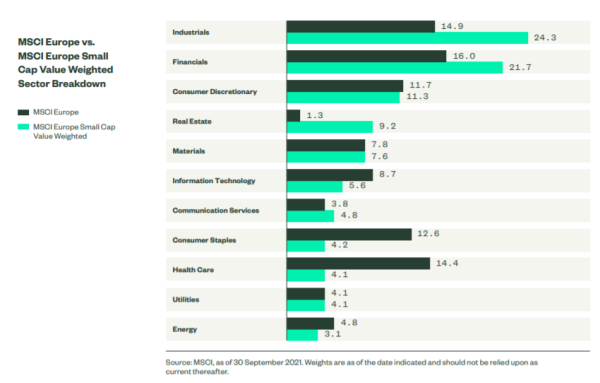

However, Europe small caps are oriented toward more traditional businesses. Heavy exposure to the industrials sector is particularly appealing as the sector may be the largest beneficiary of the next leg of the recovery, namely investments. Amid stabilising economies, corporates should start deploying their post-COVID cash piles into capital expenditure, while governments at the country and pan-European level are expected to boost infrastructure spending. These factors should support industrial companies.

Financial companies are a significant component of the MSCI Europe Index and are also one of the largest weights in both the MSCI Europe Small Cap Index and MSCI Europe Small Cap Value Weighted Index. We believe this segment is well positioned, as rising yields allow investors to capture improved net interest margins while economic recovery mitigates risks of increases in non-performing loans.

Another sector that allows investors to capture the recovery is real estate, which represents 10% of the MSCI Europe Small Cap Index and 9% of MSCI Europe Small Cap Value Weighted Index; meanwhile, for MSCI Europe the weight is only 1%. The sector is traditionally perceived as an inflation hedge but we believe that its ability to capture economic growth coming from reopening is an even more important feature given its performance gap and undemanding valuation relative to the broader market.