Fidelity: Bond markets tempt FAIT amid prospects for a steeper US yield curve

Fidelity: Bond markets tempt FAIT amid prospects for a steeper US yield curve

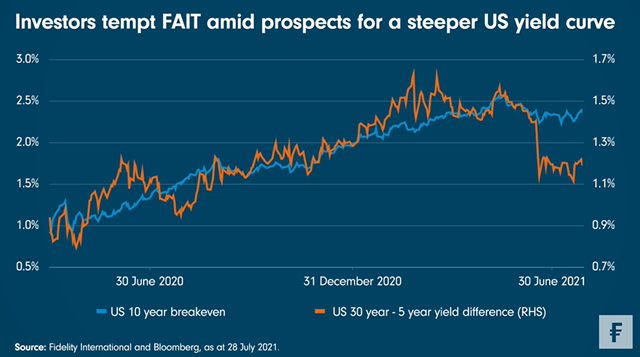

There were signs earlier this year that bond markets had grown complacent with the idea that the Fed would stand pat forever. That changed quickly after the June meeting of the Federal Open Market Committee, when the Fed gave the first signs of hawkishness. Since then some overcrowded positions have been washed out. Inflation breakevens fell and the US curve flattened.

This makes sense to the extent that the market sees risks that the Fed will not accommodate a large inflation overshoot, but we think the curve may have flattened too far. This week’s Chart Room illustrates this, by plotting US 10-year breakevens - or the implied average expected inflation rate over the 10 years - alongside the difference in yields between 30-year and 5-year Treasuries.

2021-08-13 - investors tempt FAIT amid prospects for a steeper US yield curve

Tempting FAIT

Attention will soon focus on what signals emerge from the meeting of global central bankers and policymakers in Jackson Hole, Wyoming at the end of August. But in the meantime, we can see that yields on long-dated treasuries have fallen relative to shorter-dated treasuries, even as benchmark inflation expectations have held comparatively steady. Against this backdrop, we think investors are tempting FAIT.

We believe the Fed’s average inflation targeting framework is still likely to succeed in achieving a rate ‘moderately above 2 per cent’, or even a 2 per cent inflation target, over the coming years, which would be consistent with a steeper curve ahead as markets move to price in a higher terminal rate.

This means that the spread between long and short-term interest rates would increase as yields on long-term bonds rise faster than yields on short-term bonds - in other words, the opposite of the flattening trend we’ve seen in the last few weeks.

There are two key reasons we say this. First, the June FOMC was not such a big shift relative to the FAIT framework laid out only months earlier. The Fed has always said that its new framework would be ‘flexible’, so that the central bank could address very large inflation overshoots should they occur. Second, the Fed said that it would react to realised inflation - which is what they did. Central banks have often been late to react to economic data, but the Fed is now ‘late by design’. Now isn’t the time to be tempting FAIT.