Harry Geels: The political-philosophical dilemma of oligopolies

Harry Geels: The political-philosophical dilemma of oligopolies

By Harry Geels

There has been discussion lately about the power of the American Big Tech companies (Apple, Google, Meta, Microsoft), as well as about various sectors that have grown into oligopolies (such as Energy, Food, Banking). From a social point of view, oligopolies have advantages and disadvantages. On balance, they seem undesirable.

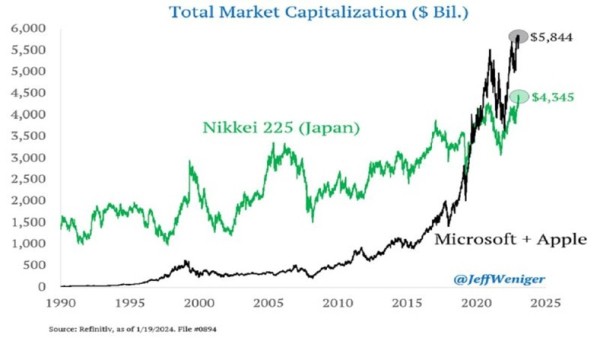

Due to the rapid rise of AI, as well as the extremely good stock market performance of the Magnificent Seven, the market power of the largest technology companies in the world is suddenly back on the agenda. Apple and Microsoft are now larger than the 225 largest Japanese companies (see Figure 1). The WEF's recently published Global Risks Report 2024 states specifically about AI: 'If monopoly- or oligopoly-led profit maximization is the primary objective of AI deployment over the next decade, the consequences for applications across healthcare, education, military, legal and financial sectors will be stuck.'

Figure 1

Companies, especially as they start using more AI, become highly dependent on a few large companies. But consumers also have to deal with increasingly larger companies. Sometimes consumers think they still have a choice, but that is often just an illusion. Behind the various 'brands' there are only a handful of large corporates. Competition authorities apparently did not see this as a problem, otherwise the oligopolies would not have arisen. But why those weak competition rules? Let's list the advantages and disadvantages of oligopolies from a political-philosophical perspective.

Social benefits

Let's start with the benefits of megacorporates. At least, as we regularly hear it. First, with oligopolies we create stable industries. In the sense that it provides stability, the corporates in question become so large and can make so much profit that they (almost) cannot go bankrupt. And if that threatens to happen (as with the credit crisis and the corona crisis), they must be rescued under the guise of 'too big to fail'. This has been true for systemically important banks for some time, but can now also be extended to other industries. The associated employment is of too great importance.

Another argument in favor of oligopolies is that their market power gives them additional opportunities to make better products. Think of all the Microsoft users reporting bugs in the software. And for Google, the better customers search, the better search algorithms will work. Online advertisers can now turn to two companies that together control a large part of the market. Due to its 'size', Booking can negotiate large discounts on accommodations. Booking can pass on its potential (at the expense of the accommodations) to consumers and shareholders (both happy).

Social disadvantages

However, the list of disadvantages of oligopolies is longer. First, innovation is thwarted because major barriers to entry are created. The innovations that still break through and are potentially disruptive are simply bought up by the megacorporates. Another disadvantage – at least from a social perspective (the megacorporates and their investors will think differently), is that the balance of power shifts from consumers to those companies. When inflation rose so fast, the largest companies had the most pricing power, so they could make a (price) increase (greedflation).

We now see another form of market power in the banking sector. Too little interest is offered, because customers have limited options to switch. A third disadvantage concerns the increasing ties between politicians, consultants and large companies. A corporatocracy has emerged, with large companies sometimes making and implementing policy together with the government. Think of how the major investment banks helped (or exerted political pressure) in combating the financial crisis in 2008 and the euro crisis of 2010. Or how the major pharmaceutical companies and governments worked together to combat corona.

Fourth, the 'too big to fail' phenomenon brings about all kinds of undesirable effects, such as 'moral hazard' and 'wealth transfers' from taxpayers to companies if they need to be rescued. Fifth, there is a risk of a social division emerging. Those who enjoy the great working conditions at the large companies and those who do not work there. Partly because of the great development and career opportunities that large companies offer, they attract the 'best' people. Small companies (and the government) are much less able to offer this.

Finally, large corporates (versus smaller companies) have more tax planning power: pay taxes where it is most beneficial. And production power: allowing production to take place where labor is cheapest or where governments offer the most incentives or the fewest regulations.

Dystopian world

Perhaps the balance of power between large and small companies, or between large companies and the government, has not yet tipped too far. But there is an undeniable, decades-long trend of ever-growing companies. If this continues, the current system of corporatocracy could evolve into a system that former Finance Minister of Greece during the euro crisis, Yanis Varoufakis, calls neo-feudalism, in which consumers (as serfs) pay monthly fees to, or their usage and passing on consumption data free of charge for exploitation by several megacaps per sector (the princes and feudal lords).

Solutions

Solving the problem starts with naming it. And with reaching social (democratic) agreement that it is a problem. If that has been achieved, a solution must be worked on. It is impossible to solve it in a column, but here are some preliminary proposals: possibly splitting up companies that are too large (it has been done before), stricter consumer protection (for example, crackdown on price fixing) and combating tax avoidance (for example by making companies pay (partially) tax on turnover in the country where they actually make it).

Furthermore, in the case of 'demonstrable' oligopolies, governments can tax (excess) profits of large corporates higher, i.e. a progressive tax based on market share (such that no more social tax is paid by all companies). And especially stricter anti-competition rules. Why did Facebook have to take over Instagram and WhatsApp? We also need to investigate whether it is possible for regular customers to become shareholders (easier) in companies on which they are 'dependent' (on a daily basis). Figure 2 speaks volumes in this regard (simplified).

Figure 2

Source: Henrique Centieiro & Bee Lee

This article contains a personal opinion from Harry Geels