Roland van den Brink: Returns, where have you gone and where are you going?

Roland van den Brink: Returns, where have you gone and where are you going?

This column was originally written in Dutch. This is an English translation.

By Roland van den Brink, Founder of TrigNum

The goal to 'make returns' is increasingly disappearing into the background at pension funds. During the election debate on pensions last November 6, the word 'returns' was not mentioned once. This is striking, since investment returns make up three quarters of everyone's pension.

Now, a week before the elections for the Dutch House of Representatives, let me start with an appeal to all political parties: 'please advocate that investment performance can be compared'. Then the discipline of the market ensures that funds constantly improve. Making this possible only requires a small addition to the adopted pension law, as pension authority Henk Bets has already argued in his explanation to the Dutch Senate. Minister Carola Schouten can easily include this in her plan to examine governance.

Market discipline leads to improvements

The weekly magazine Elsevier has been publishing rankings of schools, studies and hospitals, among other things, since the 1990s. Institutions listed at the bottom address the shortcomings, which is a positive development. What about pension funds?

The press regularly ranks and assesses the investment costs incurred, which has caused funds to increasingly invest passively, which is cheaper. The VBDO ranking, which ranks how sustainable the investment policy is, also has an influence. Funds find a low score annoying and, although they do not always agree with the VBDO system, you often see that they adapt. Publications from action groups, such as those on cluster munitions and investing in companies that do not respect labor rights or burden the environment, are also guiding principles.

Together with the public attention to the climate, this has led to more and more funds having an investment policy that focuses on excluding countries and companies and reducing CO2 emissions.

Comparing performance saves money

The Canadian company CEM has compared the performance of thousands of pension funds over 25 years. Co-founder Keith Ambachtsheer's conclusion is: 'what is measured and compared, is managed'. By comparing investment performance, the additional return is easily 0.2% per year. On a beer mat: with a pension asset of 1,500 billion, this amounts to an additional 3 billion per year, which can increase pension benefits by about 10%.

Now I hear some people think: 'more money = more investment risk'. But that conclusion is incorrect. It is about the additional return if there is more care for, and (indirectly) more control over, the strategy and its implementation. I would like to hear the arguments of the political party that is not in favor of this.

Why am I worried?

Institutions that analyzed the investment performance of funds, such as WM and Stichting Performance, have long since ceased to be active. As far as I know, no one has ever been fired from a Dutch fund due to (significant) lagging returns. This is different abroad. That is a shame, because without comparison the need to improve is not felt, which means that incorrect 'beliefs' in policy continue to have an impact for a long time, such as: 'the interest rate really cannot be lower'.

Recent research by Overrendement and Bikker/Meringa shows that improvements are possible (without running additional risks). CEM also concludes about Dutch funds via the website top1000.com: 'weaker areas include returns and the quality of benchmarks'. However, without additional regulations to the Future Pensions Act that make comparison possible - as Henk Bets advocated - the current leak will not be closed.

The new adage: social return

Social impact is the new buzzword in the pension world. More and more investments are being made in initiatives that 'do something for the climate' to direct investments. Esteemed columnists such as Harry Geels and Han Dieperink have already written about this. Without organizing market discipline regarding the results achieved, this will result in low-yielding portfolios. Here too my question is: which political party and participant wants that?

Returns, where are you going?

The climate issue will result in a political conflict within twenty years, because global warming will not stop. The latter because for roughly one third of the people on our planet, food for tomorrow is more important than climate care for later. To slow down the process, I foresee that more and more resources will be used, including those of Dutch pension funds.

This can be done in various indirect ways: persistent inflation or having to invest even more in barely-yielding government loans. Nationalization and expropriation are also possible: countries such as Argentina (2008), Hungary (2012) and Poland (2013) have already preceded us.

In short, the interests of participants are also better safeguarded in the long term if investment performance is public and comparable. Let the market continue to do its work. Minister Schouten's intention provides scope to arrange this.

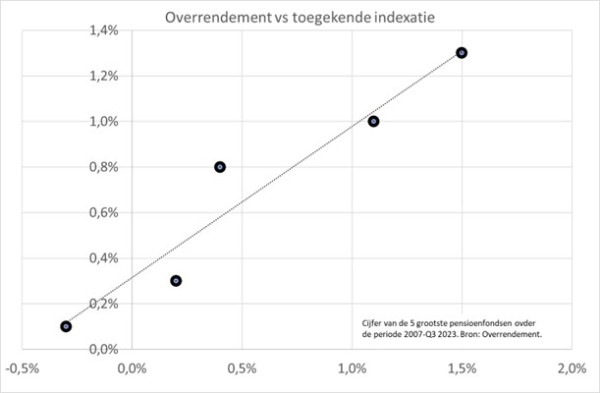

Figure 1: Excess returns vs. granted indexation

Follow the Money 2013: The nationalization of your pension is one step closer