JP Morgan AM: Bonds can diversify against disinflationary recession risks

JP Morgan AM: Bonds can diversify against disinflationary recession risks

2022 was a challenging year for multi-asset investors, with US fixed income falling alongside stocks for only the third time in the last 50 years. Since this repricing, we believe bonds are now well positioned to diversify against disinflationary recession risks.

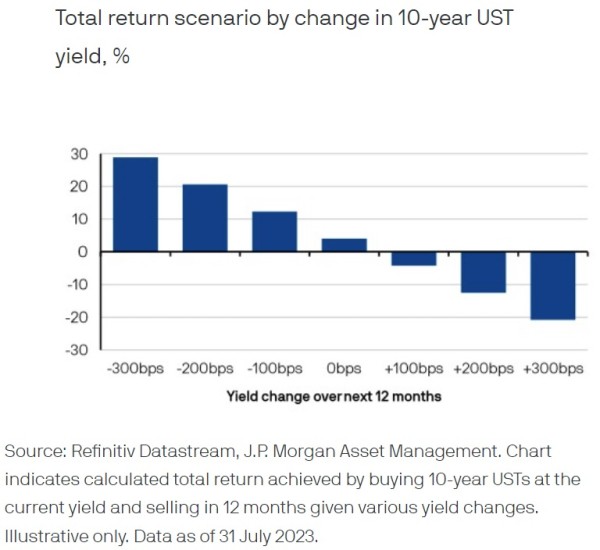

If a downturn materialises and inflation falls, the Federal Reserve would likely come under pressure to cut rates. In this scenario, a 100bp decline in 10-year yields could deliver bond returns of more than 10%, helping offset any equity losses in a diversified portfolio. Of course, alternative asset classes still deserve a place to hedge against elevated inflation risks. However, we believe bonds can now provide the income and disinflationary diversification multi-asset investors expect.