BlackRock: Hard times for CEOs, CFOs and investors

Rick Rieder, CIO Global Fixed Income at BlackRock and Head of the BlackRock Global Allocation Investment Team, comments on the US CPI report that was released yesterday.

- Today’s CPI report was expected to stay elevated, and it did little to disappoint (other than for those who would like to see inflation move closer to a 2% target).

- The key issue today, and for the foreseeable future, is that services inflation remains well-above historic norms and out-of-line with target levels of inflation for the Federal Reserve.

- In addition, Goods inflation today also remained at a high level, buoyed by the continuing pricing-strength in household furnishings and apparel.

- What is encouraging, though, is that all of the indications are that goods inflation may start coming down nicely, consistent with an economy that is moderating, with demand in areas such as used vehicles, some retail items, electronics, etc., witnessing some softness and consequently some easing of price-pressures.

- Turning to the data, core CPI (excluding volatile food and energy components) came in at 0.38% month-over-month and rose 5.6% year-over-year.

- Meanwhile, headline CPI data printed 0.05% month-over-month and came in just under 5.0% year-over-year, with declines in gasoline prices and food prices being offset by solid gains in shelter, although the shelter gain slowed in March.

- Additionally, the Fed’s favored measure of inflation, core PCE, increased 0.30% in February, bringing the year-over-year figure for the measure to 4.60%, as of that month.

- Finally, another measure that’s worth looking at, the Dallas Fed’s trimmed mean measure of PCE inflation, printed at 4.6% year-over-year in February.

- Encouragingly, some commodity price softness, including in areas such as food, are also displaying some price easing, especially when compared to last-year’s very elevated levels, which were buoyed higher by the supply shocks relating to the war in Europe.

- While we are confident that goods inflation is on the way down from here, reaching a point by year-end that could be as low as 0% year-on-year inflation, it is in the service sectors that inflation poses the primary problem.

- The question facing many of the central banks, relative to these levels of inflation, is the trade-off between inflation coming down over a longer period of time and the potential to severely damage economic and financial conditions.

- We think that central banks recognize this set of conditions today, and despite rightly “talking tough” on inflation, are modifying their expectations for the degree of tightening required this cycle.

The Services at this Place are a Problem

Today’s CPI report was expected to stay elevated, and it did little to disappoint (other than for those who would like to see inflation move closer to a 2% target). The key issue today, and for the foreseeable future, is that services inflation remains well-above historic norms and out-of-line with target levels of inflation for the Federal Reserve.

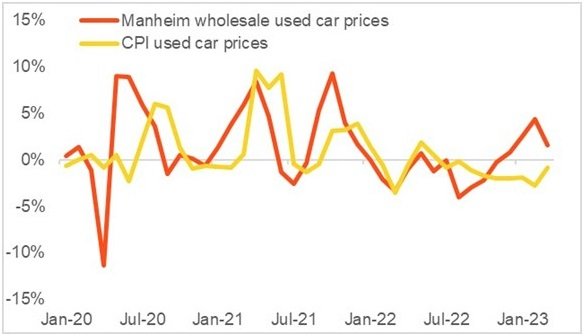

In addition, Goods inflation today also remained at a high level, buoyed by the continuing pricing-strength in household furnishings and apparel. What is encouraging, though, is that all of the indications are that goods inflation may start coming down nicely, consistent with an economy that is moderating, with demand in areas such as used vehicles (see graph), some retail items, electronics, etc., witnessing some softness and consequently some easing of price-pressures.

Sources: Bureau of Labor Statistics; Manheim; data as of April 12, 2023

Turning to the data, core CPI (excluding volatile food and energy components) came in at 0.38% month-over-month and rose 5.6% year-over-year.

Meanwhile, headline CPI data printed 0.05% month-over-month and came in just under 5.0% year-over-year, with declines in gasoline prices and food prices being offset by solid gains in shelter, although the shelter gain slowed in March.

Additionally, the Fed’s favored measure of inflation, core PCE, increased 0.30% in February, bringing the year-over-year figure for the measure to 4.60%, as of that month.

Finally, another measure that’s worth looking at, the Dallas Fed’s trimmed mean measure of PCE inflation, printed at 4.6% year-over-year in February.

Encouragingly, some commodity price softness, including in areas such as food, are also displaying some price easing, especially when compared to last-year’s very elevated levels, which were buoyed higher by the supply shocks relating to the war in Europe.

While we are confident that goods inflation is on the way down from here, reaching a point by year-end that could be as low as 0% year-on-year inflation, it is in the service sectors that inflation poses the primary problem.

Indeed, areas such as shelter (with the lack of available inventory), transportation services (such as airline fares), recreation services, etc. are still running at elevated levels of inflation and it is hard to see dramatic price-reductions here for a while.

Our forecasts are for Core Services inflation to decline by year-end to 4.5% y-o-y from 7.2% at the start of the year, but that is still high relative to history. We are seeing some of the influences on service inflation abating, including the effects of a slower economy and a tangible reduction in employment wages (from 6% y-o-y last year to 4.2% in the most recent payroll report). Hence, one would assume that this will translate through to lower services inflation more in keeping with Fed targets, but still well above the 2.0% level, unless the economy contracts significantly more aggressively than we are projecting.

Today’s data is consistent with some of the global inflation readings we have been seeing over the prior few months; it is still elevated and harder to bring down, despite historically aggressive tightening executed by global central banks, and especially in the U.S., Europe, and the U.K.

The question facing many of the central banks, relative to these levels of inflation, is the trade-off between inflation coming down over a longer period of time and the potential to severely damage economic and financial conditions. The past month provided a stark reminder of how financial institutions can come under severe stress, as we saw play out in Switzerland and in the U.S. The tightening of credit conditions, and the subsequent pressure on a number of parts of these economies, such as small business, real estate and consumer finance is cause for concern.

We think that central banks recognize this set of conditions today, and despite rightly “talking tough” on inflation, are modifying their expectations for the degree of tightening required this cycle. We would cite the recent FOMC statement and SEP, which projected 0.40% GDP growth for 2023, despite a very solid expected 2% to 3% annualized growth in the year’s first quarter. The SEP also projected a 4.5% unemployment rate, up from the 3.5% reported in the last payroll report (implying a loss of 1.67 million jobs). Finally, the latest SEP dot plot also projects a median policy rate at year end of 5.1% (only a few basis points from today’s level).

The future for economic growth and financial assets is more uncertain from here than it was a few months ago, but should the Fed take policy rates much further than implied in the last dot plot, it would render the future set of conditions even murkier. The services (inflation) at this place is indeed making the future policy prescription more difficult. That almost certainly makes corporate CEOs, CFOs and investors’ near-to-intermediate-term decision making almost definitionally more difficult as well.