Fidelity: Credit markets look cautious to a (de)fault

Fidelity: Credit markets look cautious to a (de)fault

According to Fidelity International, markets are pricing too much bad news into investment grade bonds, especially now that inflation appears to have peaked.

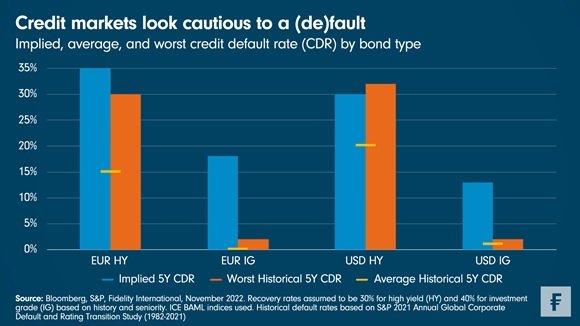

Fidelity International believes that markets are pricing in too much pessimism about the outlook for US and European investment grade (IG) bonds. This week’s Chart Room shows how current IG bond spreads are implying a five-year credit default rate (CDR) that is much higher than the worst historical occurrence. In the firm's view, spreads are priced for an unrealistically bad default risk probability.

With a number of indicators now suggesting that inflation has peaked, if central banks become less hawkish the backdrop should become more supportive for fixed income products across the credit rating spectrum. In particular, Fidelity International believes reduced fiscal support and decreasing consumer spending will hit growth and prompt a flight to quality, making IG relatively more attractive than high yield (HY).

But how quickly will headline inflation return to lower levels? Though inflation appears to have peaked in the US, it is not as entrenched in Europe, where prices have been driven higher primarily by a series of transitory exogenous shocks. If gas prices do stay at current levels and supply side issues are resolved, for instance, inflation in Europe could fall at a faster rate than anticipated by the market, causing fixed income spreads to narrow, according to Fidelity International.

The outlier in this chart is USD HY, where today’s implied five-year CDR is more benign than the worst historical occurrence. Arguably, tighter spreads in the US reflect relatively strong credit fundamentals - partly thanks to high oil and gas prices buoying the energy sector, which accounts for a bigger share of US HY - though fundamentals could deteriorate as the macro backdrop worsens and earnings downgrades feed through. More broadly, however, investment grade credit markets look cautious to a fault on default risk.