Monex Europe: Fed to hike 75bps, but dot plot to drive the dollar reaction

Monex Europe: Fed to hike 75bps, but dot plot to drive the dollar reaction

The Federal Reserve is set to raise the federal funds rate by 75 basis points to 3.25% next Wednesday following this week’s massive core CPI surprise. The upcoming decision has been far more data-driven than usual—as we noted in late August following the Jackson Hole Symposium. In intermeeting communications, Fed officials had voiced that September’s decision was a choice between 50 and 75bps, and would rest upon the totality of the data, with nonfarm payrolls and CPI inflation being the key reports.

While money market pricing reflected Fed communications for most of August, futures and swaps began to increasingly price 75bps in September, reaching an 80% chance just prior to August’s CPI report. Following CPI, however, expectations surged far higher and now suggest that 100bps, not 50, is the second-likeliest outcome at a 20-22% chance.

Looking to the distribution of forecasts supplied to Bloomberg, economists are less convinced than money markets that 100bps is as large of a tail risk. Using the full sample of 67 estimates, the split between 25, 50, 75, and 100bps is 1, 18, 46, and 2. We should note, however, that only 9 responses were submitted after the CPI report came out on Tuesday. Within that subset, only one economist called for 100bps while the remaining eight said 75bps was more likely.

“We are among the consensus calling for 75bps because we believe that the Federal Reserve would gain little from deviating from prior communications and surprising the market to address stronger momentum in core inflationary pressures,” Simon Harvey, Head of FX Analysis at Monex Europe, says.

Instead, they can avoid further tarnishing the credibility of their communications while tightening policy further by raising the terminal rate suggested in their dot plot from 3.75% previously. Nonetheless, the risk of 100bps cannot be entirely ruled out because the Fed ditched its communications as recently as June, when it leaked to the WSJ during its media blackout period that it would hike 75bps after repeatedly assuring the market that 50bps was underway.

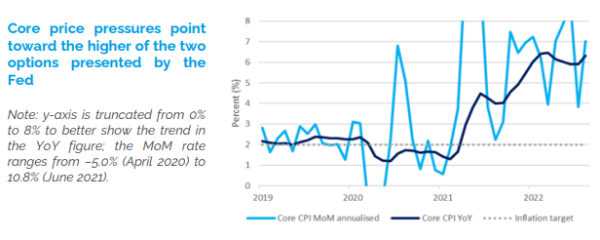

We think that this decision is fairly straightforward. From Jackson Hole onward, Chair Powell and other top officials including Mester, Bostic, Barkin, and Brainard have largely ceased any discussion of downside risks to growth, focusing their public communications almost entirely on their commitment to address inflation. Given that the key datapoint since those communications—core CPI—accelerated by 0.6% MoM (which annualizes to 7.4%) in August and brought year-on-year growth from 5.9% to 6.3%, recent underlying inflation pressures have risen substantially faster than expected and tilt the decision to the upper end of the two options laid out by numerous officials.

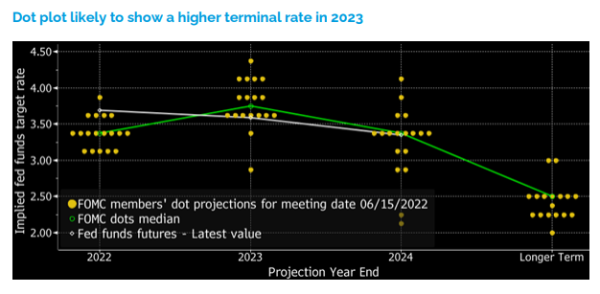

The more interesting questions pertain to the dot plot and the path to the terminal rate. The most recent dot plot from June had the median estimate for the fed funds rate rising to 3.375% in 2022 and peaking at 3.75% in 2023, before being cut to 3.375% in 2024 and dropping to 2.5% over the longer term. The distribution of expectations for the 2023 terminal rate is wide, ranging from 2.875% at the low end and 4.375%, and skews to the upside as the modal forecast was 3.625%, 12.5bps below the median. Although the Fed endorsed the dot plot back in July, spurring a loosening in financial conditions and a dollar sell-off as markets initially thought the data would lead Fed officials to revise their estimates upward, the latest inflation reading is sure to shift the terminal rate higher by at least 25bps.

“Given that market pricing of the terminal rate has shot up over 40bps to 4.5%, the risks to the dollar skew to the downside should the Fed fail to back those expectations and raise their 2023 estimations by less than 75bps,” Harvey says.