J.P. Morgan: The Fed expects policy to be restrictive by year end

J.P. Morgan: The Fed expects policy to be restrictive by year end

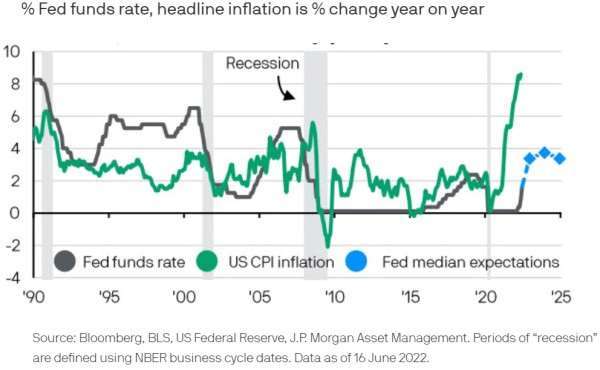

Following another upside surprise to inflation, the US Federal Reserve (Fed) again accelerated its plans to raise interest rates, delivering its first 75 basis point (bp) rate hike since 1994.

Investors and economists had expected the peak in US inflation to have occurred in March and so the new peak that was marked in the May release roiled equities as rates markets moved to price in the Fed needing to apply the brakes more aggressively.

For the next meeting, Chair Powell acknowledged that either a further 50 or 75 bp hike “seems most likely”. The precise size, as well as the path of hikes beyond the July meeting are likely to be determined by how the inflation data evolve as the Fed prioritises taming the fastest price increases in over 40 years.