State Street SPDR ETF: End to an era of bond buying?

Inflation is at historically high levels and many central banks appear to be behind the policy curve. The European Central Bank (ECB) has yet to start the normalisation process and the markets have in mind that, like the US Federal Reserve (Fed) and Bank of England (BoE), the ECB will raise rates aggressively. The ESTR forwards price 75bp of rate rises by the end of 2022 and 130bp over the coming 12 months.

While there seems to be an indisputable case for lifting policy rates out of negative territory, it may be more challenging for the ECB to embark on an aggressive policy tightening cycle for several reasons:

- Institutionally dovish: Since the 2011 ‘policy error,’ the ECB has erred on the side of caution, maintaining rates in negative territory since 2014. While the Fed and BoE were both engaged in policy tightening in 2017, the ECB kept rates steady even though CPI was at levels consistent with its target while the EU measure of Economic Sentiment hit its highest level since 2000.

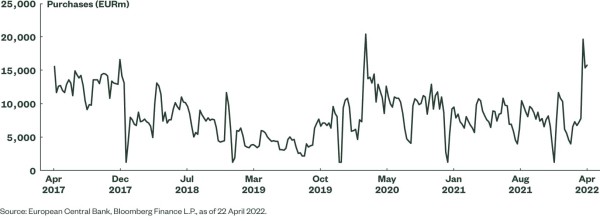

- End to an era of bond buying: The ECB has continued to buy government bonds since 2015. The latest signals from the ECB are that purchases will cease at the start of July 2022. This is already proving a shock to the system, with yields rising and core-periphery spreads blowing out. The ECB has actually stepped up its Public Sector Purchase Programme bond purchases over the past few weeks in part due to the Pandemic Purchase programme being run down but also to counteract market moves, with the rise in government yields effectively tightening monetary conditions in the euro area.

- Growth risks: Inflation may be the ECB’s target but it will be aware that much of the rise in CPI is due to energy prices. These and other global cost-push elements to inflation will not be controlled by managing aggregate demand in the economy. In fact, higher energy prices and reduced availability of some resources will actually hurt demand. Weaker business and consumer surveys suggest there are risks to growth that may give the ECB some cause for concern.

Figure 1: ECB Public Sector Purchase Programme Steps up a Gear

In short, the market now prices in a considerable amount of tightening and there are risks that the ECB does not validate this. A key disincentive to investing in the front end of the curve in the euro area has been the lack of running yield: despite the bond market sell-off, the two-year German government bond still only yields just over 10bp.

One way to enhance the running yield is to focus on investment grade credit. The yield to worst on the Bloomberg EUR Corporate 0-3 Year Index is above 95bp, its highest since mid-2014 if the 2020 Covid related spike is ignored. Spreads to government bonds have blown out to their widest since Q1 2013, again if the 2020 spike is looked through.

This is despite the fact that the cessation of ECB purchases will be more damaging for government bonds than corporate bonds, given the relative amounts purchased, and suggests that a meaningful economic slowdown is already priced by markets. Signs of financial stress are limited so far, with the upgrades-to-downgrades ratio for Moody’s dropping to 0.56 in Q1 2022 but then rebounding to 1.67 for Q2 so far. For S&P, the ratio has remained well above 2 for both quarters.

ESG still in the ascendancy

For those thinking about returning to investment grade exposures, it may be time to consider ESG. In 2021, 13 out of the 14 UCITS credit ETFs launched had some sort of ESG screening. The rise of ESG was challenged early this year by the invasion of Ukraine, which drove outperformance for the typically non-ESG-compliant sectors of energy and defence. However, there are different approaches to ESG.

Antoine Lesne, Head of SPDR ETF Strategy & Research EMEA:

“The State Street Global Advisors approach for fixed income ETFs is to create a series of indices, in conjunction with Bloomberg, that reflect the characteristics of the standard non-ESG benchmarks. This way, these exposures can be used for core holdings while at the same time enhancing the ESG rating of the portfolio. Screening then optimising the index, to both maximise the ESG score and to push the characteristics toward those of the parent index, has also helped performance. The Bloomberg SASB Euro Corporate 0-3 Year ESG Ex Controversies Select Index, the index behind our newly launched short-maturity ESG fund, has outperformed the Bloomberg EUR Corporate 0-3 Year Index by 14bp year to date3 despite the non-ESG-friendly backdrop.”