J.P. Morgan: The Fed signals its path for tapering and rate hikes

J.P. Morgan: The Fed signals its path for tapering and rate hikes

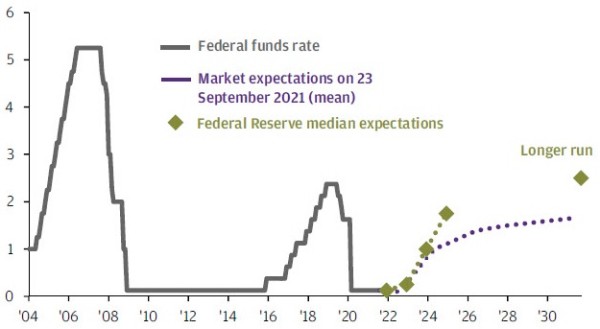

The US Federal Reserve (Fed) updated its ‘dot plot’, which signalled a first rate hike could come as early as next year and stated that a reduction in asset purchases would “soon be warranted”.

We expect “soon” to mean that tapering will be announced in November and end in the middle of 2022. In addition to a potential rate hike next year, the Fed’s latest dots signalled three hikes in each of the following two years, which would leave the Fed rate at 1.75% by the end of 2024. Market pricing remains behind the Fed’s latest dots, meaning there is room for bond yields to rise, if the Fed’s economic outlook proves accurate and it sticks to its own projected path of tightening.

% Fed funds rate and market expectations

Source: Bloomberg, US Federal Reserve, J.P. Morgan Asset Management. Market expectations are calculated using OIS forwards. Data as of 23 September 2021.