J.P. Morgan: China credit impulse points to normalising economic momentum

Over the past year China emerged as the first major economy to recover from the pandemic and is now leading the way in its policy normalisation.

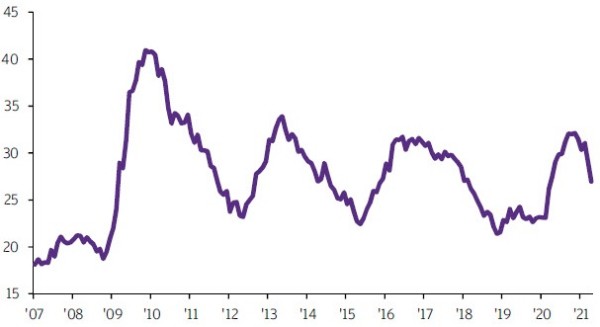

The credit impulse – the change in the amount of credit in the economy and a good barometer of Beijing’s overall policy stance – rose last year thanks to the policy support during Covid, but has moved lower more recently. As a result, Chinese demand, both internally and for international goods is likely to moderate in the coming months. With its policy normalisation well ahead of its international peers, local sovereign bond yields have recovered to pre-crisis levels. The attractive yield and diversification properties of Chinese bonds look a compelling proposition for those hunting for yield and portfolio ballast in a world of low bond yields.

12-month change in credit, % of nominal GDP

Source: People’s Bank of China, J.P. Morgan Asset Management. Data as of 28 May 2021.