Alger: This is what matters

Alger: This is what matters

By Brad Neuman, CFA, Director of Market Strategy at Alger, a La Française partner firm

With the proliferation of different takes on equity investing, ranging from algorithmic trading to retail investors utilizing chat rooms, it may be easy to lose sight of one of the first principles of investing. It’s not about what’s hot now–which stock is moving or what technology is most anticipated. It’s about future earnings.

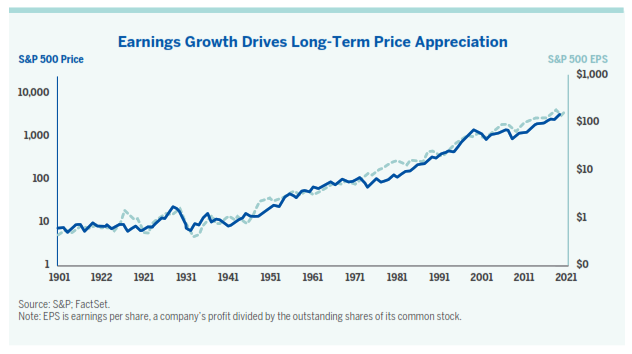

Over the past 120 years, the S&P 500’s price has increased 5.3% annually, driven by a 5.0% compound annual growth rate in EPS. In other words, 95% of stock market price appreciation has been driven by earnings growth.

This relationship reinforces the old quote from Warren Buffett’s mentor, Ben Graham: 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.'

That means that while shifting sentiment may drive variations in stock prices in the short term, long-term changes in equity prices have historically reflected actual corporate results.

With news stories about stock prices being driven up based on short interest or other nonfundamental considerations, investors may want to get back to first principles and embrace research and sound decision making. After all, the stock market is the ultimate corporate fundamental weighing machine.