Schroders: Developments in China’s balance of payments and implications for the RMB

By Craig Botham and Kristjan Mee

China’s falling current account surplus has received a lot of attention recently. The fall in the surplus follows a large capital outflow between 2014 and 2016. In the midst of this turbulence, foreign investors are allocating more and more funds to China. What should investors make of all of this?

In the first quarter of 2018, China’s current account fell into deficit for the first time since 2001. While the deficit could have partially been explained by seasonality, the subsequent quarters have shown that this was not a blip. The rolling four-quarter surplus was just 0.4% in Q4 2018. At the economy level, the vanishing current account surplus indicates a major fundamental change - the large pool of domestic savings is now close to fully utilised in financing the high level of investments.

The shift to a lower surplus is mainly facilitated by the weakness in manufactured goods exports and the increase in outbound tourism. While the cooling economy and lower oil price could slow the deterioration, structural drivers, such as an ageing population and rising wages, should continue to push the current account lower.

China’s current account surplus has evaporated

China current account balance, %GDP

Source: Schroders, Thomson Reuters Datastream. Data as at Q4 2018

The potential current account deficit is negative for the renminbi (RMB) and the funding of that deficit is key for how negative it will prove. By finally opening up its financial markets to foreign investors, China has started to attract substantial institutional inflows. Over the last five quarters, the foreign portfolio inflow has amounted to $247 billion. China’s inclusion in global benchmark indices over the next few years could lead to additional hundreds of billions of inflows.

Higher foreign participation in the local market is a necessary a step in the RMB’s internationalisation process and the inflows could finance at least a part of the potential current account deficit. However, foreign investment flows are also, to some extent, dependent on the economic sentiment. By allowing more foreign participation in the local market, the authorities’ ability to control currency movements will reduce.

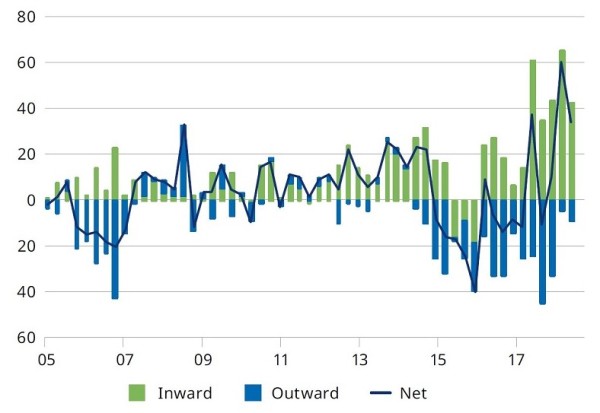

Inward portfolio investment has increased sharply since 2017

China portfolio investment, billions USD

Source: Schroders, Thomson Reuters Datastream. Data as at Q4 2018

Worryingly, the weakness in the RMB resurrected domestic capital outflow in the latter half of 2018. The persistently negative errors and omissions account shows that Chinese residents continue to find ways to evade the capital controls. In addition, the sizable external liabilities balance looms over the capital account, providing potential fuel for the outflow.

Since July 2018, the People’s Bank of China (PBoC) has taken multiple steps to support the RMB. This, coupled with progress in the US-China trade negotiations, has led to small rebound in the currency. Looking ahead, China faces a tough choice between stabilising the currency and supporting the economy. Sizeable FX reserves can provide some relief, but are likely not large enough to act as an ultimate backstop in the face of substantial outflows. Given the lack of alternatlives, the PBoC might be forced to let the RMB float if the pressure on the currency becomes too great.