Fidelity: China’s tourists tiptoe out again

Fidelity: China’s tourists tiptoe out again

A slow economy didn’t deter Chinese tourists from getting out and about during October’s ‘Golden Week’ National Day holiday — the first since the country ended three years of Covid travel restrictions. But where they went and how they spent says a lot about consumer confidence and changing tastes.

The sound of Mandarin in the tourist hotspots of Europe and Asia is the surest sign yet that Chinese travellers are stepping out again in force. At a resort in the Maldives, one of our colleagues estimated that 80% of guests were Chinese speakers during October’s week-long holiday.

Another colleague, bound for Europe, was stuck in a long queue for visa appointments at the consulate, with dealers trying to sell skip-the-queue access at as much as RMB 2,000 (US$270). Both leaving China and returning, his flights were fully occupied. A comprehensive recovery in cross-border mobility, already back at above 70% of pre-pandemic levels before October, now looks within reach.

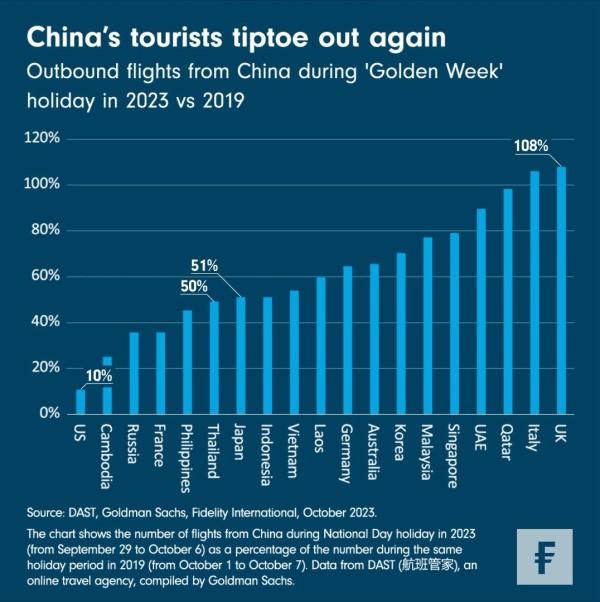

But thus far into the new post-Covid normal, the destination map for China’s outbound travellers looks a bit different. Pre-pandemic hotspots like Japan and Thailand managed only half the number of flights during this year’s National Day holiday, compared with the same holiday in 2019, according to data from DAST, an online travel agency, as compiled by Goldman Sachs.

Travellers have perhaps been deterred by Chinese social media, which is awash with warnings over Tokyo’s disposal of nuclear wastewater, or cautionary tales about rampant cases of telephone fraud or trafficking by cybercrime syndicates in Southeast Asia.

More staggering is the decline in America’s popularity as a destination (the number of flights reached only 10% of 2019 levels); this could be related to strains in bilateral ties, but it’s also a function of the comparatively slow post-lockdown resumption of flights, as these only ramped up in August.

Of course, base effects play a part, and we can’t discount the drawback of a marginally weaker renminbi, which makes overseas travel relatively pricier. On the other side of the coin are destinations that far surpassed their 2019 levels of flights, like the UK and Italy. The increases may indicate these markets gaining share from those that have slumped, but is likewise probably also a testament to speedier resumption of flights.

Not-so-conspicuous consumption

In a sense, Chinese outbound tourism is a reflection of what’s going on at home. In Singapore, which saw the number of flights from China recover to 80 per cent of 2019 levels, we observed fewer Chinese visitors splashing cash on luxury goods.

Indeed, news reports in the city state say the number of inbound group tours fell 80% from 2019; instead, individual tourists roamed the streets, not unlike the ‘city walk’ trend popular among young people in China of avoiding pricey tourist hotspots, effectively a form of consumption downgrade.

Ultimately, travelling is discretionary spending. Tourism bosses have been betting on the Chinese desire to go out following three years of pandemic restrictions. But with consumer confidence still not back to form, a full recovery may take some time yet.