Fidelity: The Fed’s ‘blocked drain’ conundrum

Despite signs of inflation easing off its peak, interest rate hikes have yet to flow freely and fully throughout the system. Consider the curious case of net interest payments, which have been falling rather than rising during the latest hiking cycle.

When the drain is blocked, sometimes turning the tap on full blast can help flush out the system. But there are risks – especially if all that water stays clogged in the pipes, the damage could be worse once things eventually burst through.

In their fight against inflation, central banks have similarly struggled to get monetary policy to flow through to the real economy. While headline inflation has come down from its peak, underlying inflation is still sticky and economic activity shows continuing resilience, suggesting the effects of the flood of interest rate hikes since early last year are still getting stuck in the pipes.

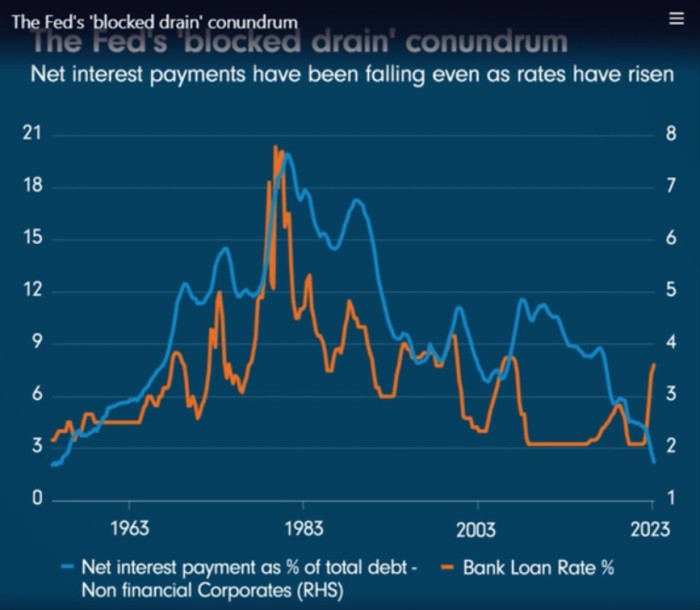

This week’s Chart Room shows that block in action. While the US Federal Reserve has been pushing interest rates to decade highs, net interest payments as a percentage of total debt for US corporate borrowers have fallen to near all-time lows.

In fact, payments have fallen almost directly in line with rates rising, flipping the previously positive correlation between the two that had dominated for the past seventy years.

One potential reason for the inversion is that corporates are feeding on a glut of cheap liquidity borrowed during the Covid pandemic at low fixed rates. This has effectively gifted them a positive carry trade, earning a spread on interest-free cash leftover from the pandemic era, and interest income on today’s floating rate assets that can exceed 5 per cent.

The question for policy makers is do they add more water into the drain - with further rate hikes - or wait to see if the system can recalibrate on its own? At last week’s Jackson Hole conference, Fed Chair Jerome Powell erred on the side of giving the system more time to adapt to higher rates, while making it clear that the Fed was definitely not dismissing the option of turning the taps on again.

When the levee breaks

This week’s Chart Room raises the question of whether or not the monetary policy transmission mechanism has been fundamentally broken, or simply delayed. Our view is the latter - we believe that the cumulative impact of the tightening we have already seen will start passing through to the economy more forcefully in the first half of 2024. However, if there really is a burst pipe in the system, then the interaction of looming maturity walls and much higher interest rates will (eventually) leave a lot of mopping up to do.