World Gold Council: The case for a strategic allocation to gold

With the rapid growth in funding ratios over the past year, an increasing number of Dutch defined benefit (DB) pension schemes are contemplating their investment approach given the breadth of macroeconomic challenges ahead.

By Jeremy De Pessemier, Asset Allocation Strategist, World Gold Council

Our research shows gold is a clear complement to equities and broad-based portfolios. A store of wealth and a hedge against systemic risk, gold has historically improved portfolios’ risk-adjusted returns, delivered positive returns, and provided liquidity to meet liabilities in times of market stress.

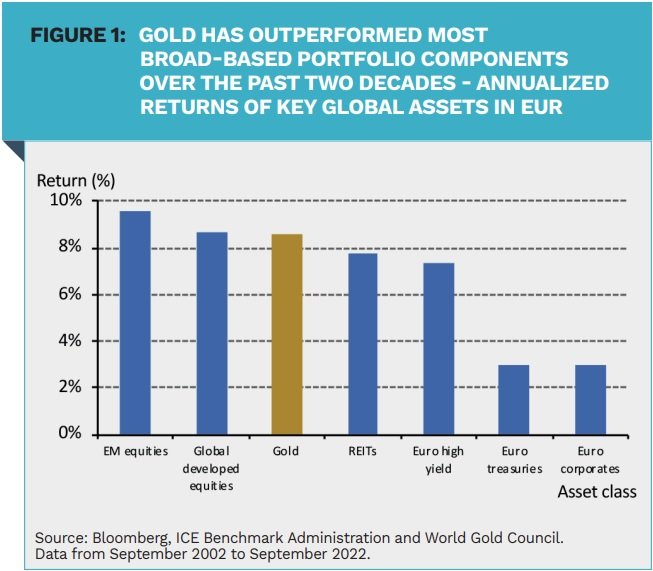

Investors have long considered gold a beneficial asset during periods of uncertainty. Yet, historically, gold has generated long-term positive returns in both good and bad economic times, outperforming many other major asset classes over the past 20 years (Figure 1).

The diverse sources of demand give gold a particular resilience and the potential to deliver solid returns in various market conditions. Gold is, on the one hand, often used as an investment to protect and enhance wealth over the long term, but on the other hand it is also a consumer good, via jewellery and technology demand.

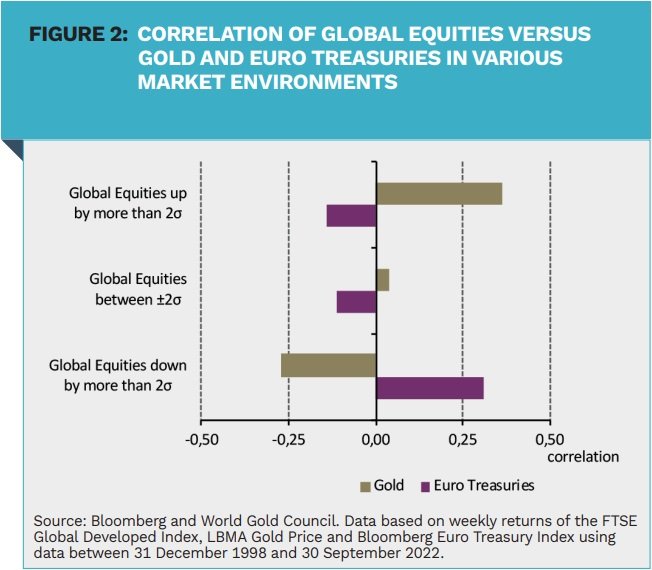

Furthermore, while effective diversifiers are sometimes hard to find, with many assets becoming increasingly correlated as market uncertainty rises, gold is different in that its negative correlation to equities and other risk assets increases as these assets sell off (Figure 2).

Implications of adding gold to a typical Dutch pension fund

Let us now illustrate how an allocation to gold can help improve key regulatory and solvency risk metrics, that is expected return on required capital and expected return on solvency risk ratios. Improving these key metrics should help pension funds achieve their strategic objective: paying its members the benefits they’re owed as and when they fall due.

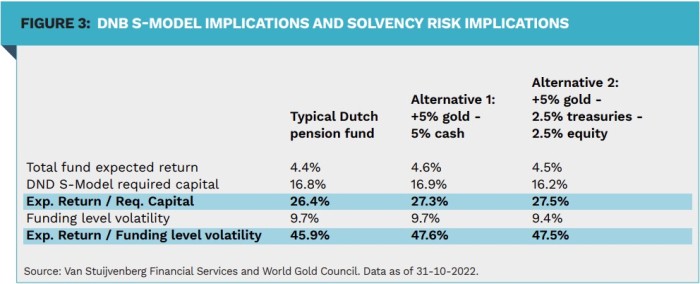

For our analysis we assume a typical Dutch pension fund asset mix of 27.5% in liability matching assets, 25% in credit, 37.5% in equity, 5% in real estate, 5% in cash and a funding level of 105%.

The portfolio also holds a liability hedge overlay to stabilise its funding ratio. This together with the matching bond allocation and credit exposure, brings the overall hedge ratio to 60% on a mark-to-market valuation basis, and roughly 65% on the DNB UFR curve rate basis.

Moreover, the Dutch regulator requires pension funds to maintain a reserve on top of the regulatory value of the pension claims they guarantee. The size of this buffer depends on the type of investments the pension fund makes and is determined by the so called DNB S-model. For our average pension fund the DNB S-Model indicates a required capital of 16.8%. So in order to comply, the fund should have a solvency ratio of 116.8% or above.

Impact of adding gold from a regulatory perspective

Whilst the Dutch pension system will, over the next few years, be changing to a new system that comes close to a defined contribution arrangement, the current regulatory framework remains important. In fact, a pension fund’s required capital (solvency buffers) remains front and centre of pension funds’ minds when making asset allocation decisions. If a pension scheme’s funding ratio falls below their required capital, they will not be eligible to make asset allocation changes which would lead to an increase in the required capital. In contrast, pension funds with solvency ratios above their required capital will be somewhat less constrained and permitted to make changes that raise the DNB S-Model required capital.

For the latter category, funding a gold allocation from cash could be an interesting option. While the required capital rises marginally from 16.8% to 16.9%, the expected return goes up from 4.4% to 4.6%, leading to an increased expected return on required capital ratio (Figure 3).

For those pension funds with solvency ratios below their required capital (which includes our hypothetical portfolio), our analysis finds funding a gold allocation from euro treasuries and equities (while maintaining the hedge ratio constant) is an appealing option. In this scenario the expected return remains broadly the same, while the required capital goes down resulting in an improved expected return on required capital ratio.

The lesson here is that from a regulatory perspective, gold is an interesting asset in that it can improve the expected return on required capital ratio for portfolios that are both constrained and unconstrained from a DNB S-model standpoint.

Impact of adding gold from a solvency risk perspective

As a next step we look at the solvency risk implications of adding gold to our hypothetical pension fund, using Van Stuijvenberg Financial Services’ proprietary risk model. Solvency risk is measured as the volatility of the fund’s solvency ratio with liabilities priced using the UFR discount curve.

Looking again at funding a gold allocation from cash, the expected return goes up, while the solvency risk remains broadly unchanged. As a result the expected return to solvency risk ratio goes up from 45.9% to 47.6%.

As discussed in the previous section, funding a gold allocation from cash may not be an option due to regulatory constraints. Funding gold from euro treasuries and equities is however a possibility for all pension funds. This keeps the fund’s expected return broadly equal while reducing the solvency ratio volatility. As a result the expected return to solvency risk ratio increases, making an allocation to gold a sensible and effective decision.

Conclusion

Following the significant improvement in funding levels over the last year and the breadth of macroeconomic challenges ahead, there is a sharper focus on risk management among Dutch DB funds. Schemes focused on maximising outcome certainty should have a preference for an asset mix which reduces solvency risk while abiding to the required capital constraints.

As demonstrated in our hypothetical case study, an allocation to gold can help mitigate the key risk faced by DB schemes – namely, uncertainty of being able to pay pension benefits – by improving the expected return on required capital ratio, contributing to longterm growth, and providing diversification that improves the expected return on solvency risk ratio.

|

SUMMARY With the rapid growth in funding ratios over the past year, an increasing number of Dutch DB pension schemes are contemplating their investment approach given the breadth of macroeconomic challenges ahead. Our analysis suggests that gold is an effective addition to a Dutch DB portfolio, helping a plan achieve its objective by improving the expected return on required capital ratio and providing diversification that improves the expected return on solvency risk ratio. |