J.P. Morgan AM: Investors should not discount green bonds

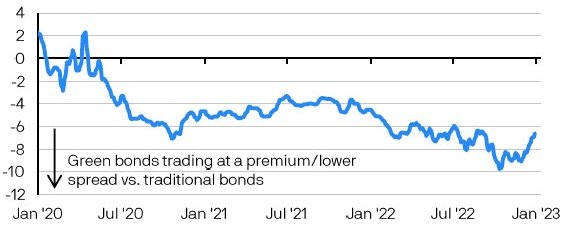

Green, social, and sustainable bonds trade at a premium to their traditional peers. This makes them attractive to issuers as they can lower the cost of capital.

On the other side though, investors are forced to accept lower yields.

As we discuss in our latest On the Minds of Investors: 'Green bonds: Is doing good compatible with doing well in fixed income?', there are potential reasons for accepting this premium beyond wanting to do good. Green, social, and sustainable bonds tend to exhibit lower spread volatility than non-green bonds.

Coupled with a rapidly growing market and explicit support from the European Central Bank, even those investors who are not necessarily aligned with the non-financial goals of green, social, and sustainable bonds should not discount them from their asset allocation.

Basis points, option-adjusted spread difference between green and traditional EUR denominated bonds

Source: Barclays Research, J.P. Morgan Asset Management. Data shown is for a Barclays Research custom universe of green and non-green investment grade credits, matched by issuer, currency, seniority and maturity. Data as of 30 December 2022.