State Street SPDR ETFs: A new landscape for bonds

State Street SPDR ETFs: A new landscape for bonds

State Street SPDR ETF’s published its Q1 Bond Compass ‘A New Landscape for Bonds’ in which it has identified three key considerations for fixed income investors in the coming quarter regarding investment grade credit, emerging market debt and short-maturity funds. The re-shaping of the bond landscape means that investors are no longer penalised for opting for short-maturity strategies, State Street SPDR ETF’s states.

For the first quarter of the year, State Street SPDR ETF’s defines three main investment themes for fixed income:

1) Use investment grade credit to fight volatility.

While the policy cycle appears to be turning and fixed income exposures have started to perform well, Q1 could remain rocky. We look for yield in part to reduce the impact of volatility. Investment grade credit fits the bill given it’s higher yielding than government bonds but likely not too exposed in the event of a material growth slowdown.

2) Headwinds becoming tailwinds for emerging market debt.

EM debt offers a high yield and the potential for performance as the central bank cycle turns. A further softening of the US dollar and the rebuilding of EM debt holdings could provide additional momentum. US dollar strength weighed on EM debt in 2022 – but that trend reversed in Q4 2022 and we expect the US dollar to weaken further. In addition, sentiment among EM central banks has turned less hawkish (more so than for their developed market counterparts).

3) Invest in the short end until it becomes clear that the investment cycle has truly turned.

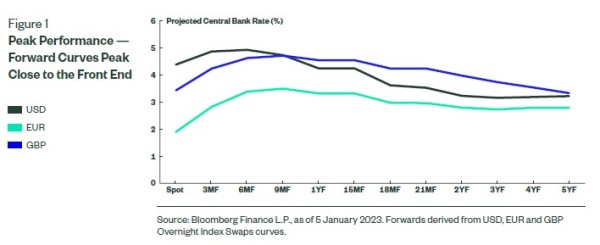

The reshaping of the bond landscape, with far higher yields and flatter curves, gives investors options for the current environment. Those who see an uncertain quarter ahead for asset markets can focus on short-maturity funds, which now provide respectable yields. We see opportunities to express this theme in the US and UK.

Jason Simpson, Senior Fixed Income Strategist at State Street SPDR ETF’s comments:

“The success of themes one and two depends on inflation continuing to move to lower levels in both developed and emerging markets, softer growth and a weaker USD. Flows into IG credit were strong in Q4 as investors rebuilt holdings. We expect this trend to continue into Q1 2023 but, with the larger underweight positions now covered, we would expect more of a skew toward ESG strategies. Moreover, EM bond returns in 2023 will be well supported by coupons but performance could also come from an improvement in the economic backdrop for fixed income or from the continued depreciation of the USD. For non-USD-based investors, this does raise the issue that these gains will not translate into performance in their local currency. As outlined in the third trend, the re-shaping of the bond landscape means that investors are no longer penalised for opting for short-maturity strategies. These investors could consider hedging out their USD risk. In order to benefit from high yields and some potential for roll-down (rather than the drag from roll-up) positioning at the very front end of the curve makes sense (see Figure 1).”