La Française: A lack of consensus on risky assets

La Française: A lack of consensus on risky assets

By François Rimeu, Senior Strategist, La Française AM

Equity and credit markets have suffered greatly since the beginning of the year. Following this type of correction, it is natural to consider whether or not to increase the allocation to risky assets as a whole.

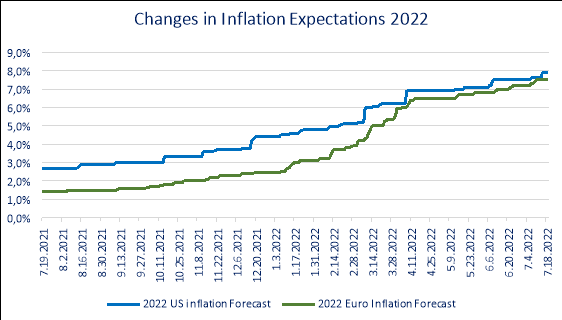

These days, getting a grasp on Inflation is not easy. A year ago, the market expected average inflation in 2022 to be 1.6% in the eurozone and 2.9% in the US, reaching a peak at the end of 2021, and in 2023 a return at around 1.5% in Europe and 2% in the US. (Bloomberg) Today, these same markets are forecasting inflation of 8.2% in the eurozone and the US for 2022 and a relative decline in inflationary pressures for 2023, with price rises still around 4-5%. Naturally, the war in Ukraine and the enormous consequences on the commodity markets only go so far in explaining these errors in estimation. We should bear in mind that if inflation estimates were revised upwards by more than 5% (see Chart 1) over the last twelve months, it is easy to imagine these estimation errors recurring, in either direction.

Chart 1 (Bloomberg):

In the short term, this leaves central banks with little choice as to what monetary policy to pursue. They want to avoid a de-anchoring of inflation expectations and will therefore continue to tighten their monetary policies with the generally assumed objective of reducing demand.

Macroeconomic dynamics

Growth forecasts for 2022 have dropped significantly since the start of the year, for example falling from 3.9% to 2.1% in the United States, from 4.2% to 2.7% in Europe and even from 5.2% to 4.1% in China. However, we believe these downward adjustments are not over yet.

Central banks will continue with more restrictive financial conditions, which should lead to a decline in leading indicators and therefore to lower growth expectations. The graph below illustrates the strong dependence of the PMI (purchasing manager's index) on monetary growth.

Chart 2:

Consumer confidence indexes are now extremely low in most developed countries. Although households did bolster savings during the Covid crisis, we believe that current uncertainty about inflation and growth should put the brakes on consumption fairly quickly.

The most advanced indicators also show us that business should continue to slow down. Such is the case, for example, with regional Fed surveys in the United States, or if we analyse the breakdown of the latest PMI surveys (new orders down sharply, inventories up strongly, etc.).

It does not seem reasonable to expect growth forecasts to stabilise in the short term, unless some major positive news emerges despite the context of very high inflation coupled with rapid monetary tightening.

Impact on profits

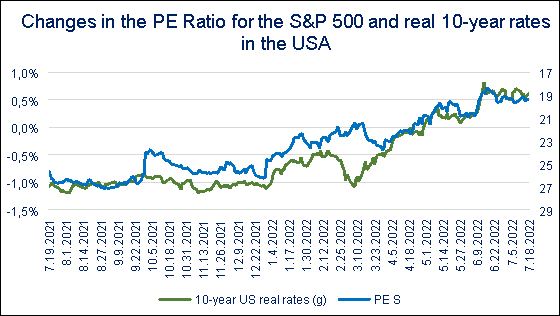

Major equity markets have so far fallen by about 20%, broadly in line with the adjustment to tighter financial conditions. This is what we see in Chart 3 with a “Price Earnings Ratio” for the S&P 500 decreasing from 26 to 19 while at the same time, real 10-year rates in the United States have gone from -1% to 0.6%.

Chart 3 (Bloomberg):

The main issue for us as a management company today is whether or not earnings are correctly estimated by the market. The consensus currently expects around 10% earnings growth in the United States for 2022 and 8% for 2023 – figures that have been constantly revised upwards in recent months. We believe these figures will be lowered over the next few months for much the same reasons as those detailed above. Falling consumer confidence has a negative impact on the earnings cycle, as does monetary tightening or downward revisions to economic growth. The magnitude of future downward revisions will depend on the scope of the economic slowdown and the persistence of inflationary risks, which are currently difficult to estimate.

As part of our allocation, we will wait and see what happens with risky asset markets due to the fact that there is significant risk weighing on future economic activity, tighter monetary policies and a consensus that has not sufficiently adjusted for future corporate earnings. On top of this, of course, are fears that energy rationing could be introduced in Europe this winter or that another wave of Covid may once again disrupt activity in China.