NN IP: The long-awaited escalation

NN IP: The long-awaited escalation

The Ukrainian situation has continued to be the main factor driving financial markets over the past week. It is the main reason why energy prices have risen further, risky assets have remained under pressure and bond yields have moderated somewhat. But while the focus has moved away from central banks to geopolitics, recent economic data show that the easing of Covid-related mobility restrictions is causing growth in activity to accelerate.

This, combined with rising energy prices, means inflationary pressure is likely to remain high. As such, it’s important to continue monitoring central banks in the current environment. We remain positioned for further disappointing inflation figures and faster monetary policy tightening through underweights in US Treasuries, German Bunds, emerging market local currency bonds and investment grade credit. But we have reduced some of our underweights as the rising geopolitical tensions could cause bond yields to fall temporarily.

The Russian army enters Ukrainian territory

After months of increasing tensions between Russia and the West over Ukraine, the inevitable escalation finally occurred on Monday. By officially recognizing the separatist-held parts of Donetsk and Luhansk, the Russian government justified the entry of troops into these regions of Ukraine, a move that has also created a new base from which further attacks on Ukrainian territory can be launched.

As we wrote in last week’s edition of the Houseview, we do not believe that Russia is preparing a full-scale invasion of Ukraine with the intention to occupy large parts of the country. Its main aim is to weaken Ukrainian President Volodymyr Zelensky’s government and lay the groundwork for a new regime that would act in the interests of the Kremlin and drop Ukraine’s ambitions to join NATO or the EU.

With Russia’s recognition of the self-proclaimed republics in Donetsk and Luhansk – including the two-thirds of the regions’ territories that are still controlled by the Ukrainian authorities – the Minsk framework that sought a diplomatic resolution of the Donbas conflict has ceased to exist. Large-scale military confrontations between Russia and Ukraine have become more likely as a result.

We will closely watch how the Ukrainian army responds to the Russians’ entry. If the Russian troops remain within the territory already held by the separatists, there might be limited military conflict. But such a scenario now looks unlikely after the Russians claimed the whole territory of Donbas.

Further sanctions likely

For the US, the European Union and their allies it has become even more urgent to come up with meaningful sanctions against Russia.

So far, the sanctions that have been confirmed have been directed against individual Russian politicians and oligarchs with close ties to the Kremlin and a number of banks. The trade of newly issued Russian government bonds has also been banned in the US, Europe and Japan. More sanctions are being considered and probably being prepared, including a ban on Russian high-tech imports and the exclusion of Russia from the Swift international financial system.

In the event of extended military confrontations between Russian and Ukrainian troops outside the Donbas region, other sanctions would probably be considered, including restrictions of Russian exports – in which case energy prices would probably spike.

Although the Russian government is prepared for international sanctions, it is probably still expecting that disagreement among Western allies and Europe’s dependence on Russian energy supplies will mean the damage to the Russian economy remains manageable. In this context, the decision by the German government to freeze the authorization of the Nord Stream 2 gas pipeline from Russia should be seen as a setback that was probably unexpected to materialize so quickly.

Scaled back risk exposure in our multi-asset model portfolio

Even in a scenario in which there is initially a limited armed conflict within the Donbas area, uncertainty remains high, and it is not difficult to imagine further escalation. As a result, we have scaled back some of our risk exposure in our multi-asset model portfolio. As we mentioned in the introduction, we want to remain positioned for high inflation and further monetary tightening, but due to the heightened geopolitical risk we closed our underweight in US TIPS and reduced our underweight in Italian government bonds from large to moderate.

On balance, we judge that headline risk should be treated as noise around a longer-term trend of bond yields moving higher. We still expect the Fed’s and ECB’s hawkish narratives to keep the trend of higher interest rates intact. Although the market has sharply increased its rate hike expectations, we think that quantitative tightening and rate hikes should push the 10-year US Treasury yield closer to 2.5% in the coming quarters alongside continued flattening of the yield curve. We have benefitted from our moderate underweight in Eurozone investment grade credit during risky assets’ recent falls. This has helped offset some of the underperformance of our underweights in rates over the past week.

Reasons to remain overweight the Eurozone

We have made no changes to our equity allocation. We remain neutrally positioned in equities overall, with overweights in the Eurozone and China. We are also maintaining our exposure to sectors that should benefit from higher bond yields and commodity prices.

Of these positions, our moderate overweight in the Eurozone is probably the most controversial. In the short term, our allocation to Eurozone equities is most at risk from an escalation in Ukraine. The direct impact of the conflict on European companies is limited, though. More important is the indirect impact via higher energy and food prices. These affect households’ disposable incomes and, in turn, companies’ revenue growth. Higher input costs will also put additional pressure on profit margins. The key unknown will be the ECB’s reaction: will it remain dovish for longer to prevent a sharp tightening of financial conditions, or will it pursue its hawkish path?

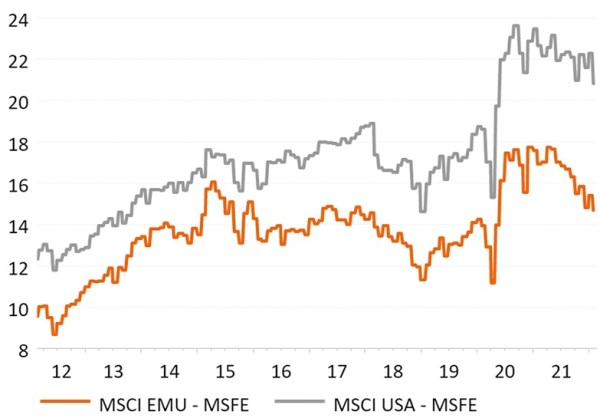

Equity valuations have fallen in absolute terms over recent months. If we look at price-to-forward-earnings, European equities are currently trading in line with their pre-Covid levels. In contrast, the US market continues to trade well above where it was before the pandemic hit (see figure). Elevated valuations in the US and US equities’ higher vulnerability to rising bond yields due to their greater exposure to high-growth sectors such as technology, consumer discretionary and communication services are reasons why, for now, we maintain our moderate overweight in the Eurozone.

Price to 12-month forward earnings

Source: Refinitiv Datastream, NN Investment Partners