Fidelity: India eyes a bigger slice of export markets

Fidelity: India eyes a bigger slice of export markets

Rapid income growth means more Indian households are buying their first washing machines, vacuum cleaners, and other mod cons. While one might expect this to drive demand for imported white goods - and it has - government policies aim to turn India into a major exporter of them.

Where demand leads, production soon follows. Assuming that principle holds, India may soon increase its share of Asian exports. A decade ago, India’s trade deficit was a major policy headache. Today, this fast-growing economy is attempting to narrow the gap by becoming a manufacturing and export hub.

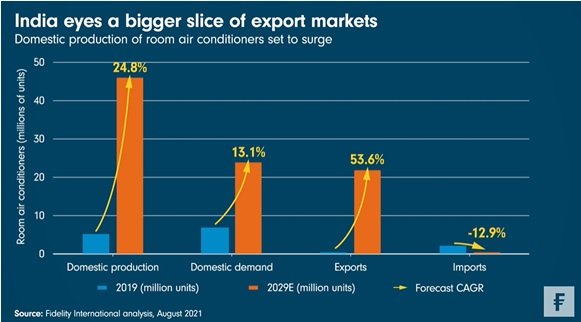

Take the market for room air conditioners. Today, India is a net importer, and a growing market for overseas aircon manufacturers. Demand is growing fast as incomes expand; we expect domestic demand to hit 24 million units in 2029, a three-fold increase in ten years. But domestic production is expected to be nearly double that figure: 46 million units, more than nine times 2019’s output, with the surplus being sold abroad.

Based on this forecasted growth, India would swing from being a small net importer of room air conditioners to a sizeable net exporter, with total exports climbing from around 300,000 units in 2019 to 22 million in 2029. If this trend takes hold with other types of white goods, or other light industrial consumer goods categories, then India could one day fulfil its ambition to become a major global exporter.

“Atmanirbhar Bharat” - self-reliant India

The government’s ‘Make in India’ initiative, popularised by the slogan ‘Atmanirbhar Bharat’ (self-reliant India), envisages this kind of growth trajectory. Living standards are rising in India, with per capita income climbing from US$1,600 in 2015 to US$2,000 in 2018 and expected to be above US$2,700 by 2025.

In addition, favourable demographics mean India is expected to add another 200 million people to its workforce by 2050. All of which represents growing domestic demand. Atmanirbhar Bharat aims to channel this demand towards domestically produced goods and use it as a springboard into world markets.

White goods, a category that includes components for air conditioners and LED lighting, is one of 13 sectors the government has targeted for Production Linked Incentives (PLI).

First announced in 2020 and currently being rolled out, the PLI scheme seeks to encourage domestic and foreign firms to use India as a manufacturing base for a diverse range of sectors, including white goods, electronics, telecoms, foods, textiles, batteries, and pharmaceuticals.

Up the value chain

The idea is to develop not just more manufacturing, but more high-value manufacturing. So alongside financial incentives, the PLI scheme also encourages firms to substitute domestically made components for imported ones and uses targeted non-tariff import barriers. For example, the government recently banned the import of gas-charged air conditioners.

Other air conditioner components that look ripe for import substitution include motors, printed circuit boards and crossflow fans. We have seen industry estimates suggesting that, thanks to PLI, India-based manufacturers could be capturing more than 75 per cent of the added value in this market by 2029, up from 25 per cent today.

India’s white goods market is worth US$15 billion, according to Euromonitor, and has grown at an average of 10-12 per cent over the last five years. Now, with government help, domestic producers are in a good position to capture a greater share of a growing market, and make inroads abroad too.