J.P. Morgan: US inflation continues to rise

J.P. Morgan: US inflation continues to rise

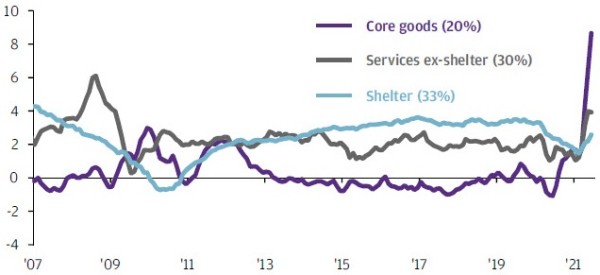

US inflation data for June came in significantly higher than economists expected – headline consumer price index (CPI) inflation rose to 5.4% year on year (y/y), while core CPI rose to 4.5% y/y – the highest reading since 1991.

Many of the price increases in areas most affected by the reopening are likely to temper in the coming months – used cars, hotels and airfares, for example. But price increases in other areas raise the prospect that underlying inflationary pressures are set to linger longer than most currently expect.

he shelter component – which historically moves in long cycles – is one such area to watch. Shelter accounts for a third of the inflation basket and rose to 2.6% y/y in June. Should it become clear that inflationary pressures are going to persist, the Federal Reserve may deem it appropriate to begin normalising policy more swiftly than it currently anticipates.

% change year on year (with 2021 CPI weights in parentheses)

Source: BLS, Refinitiv Datastream, J.P. Morgan Asset Management. Core goods CPI is defined as goods CPI excluding food and energy. For the CPI weights, the remaining 17% weight not shown in the right chart is allocated to food and energy within the goods sector. Data as of 16 July 2021.