Fidelity: What Japan’s digital transformation means for markets

Fidelity: What Japan’s digital transformation means for markets

"Something decisive is happening now." So begins Nishiyama Keita’s new book, DX way of thinking: The strongest strategy for reviving the Japanese economy, published this April.

Mr. Nishiyama, a former official at Japan’s Ministry of Economy, Trade and Industry (METI), has a point - one that investors would do well to heed. Corporate Japan is abuzz with talk of digitisation these days, and METI and the Tokyo Stock Exchange recently named a group of 28 “DX Stocks” for 2021. These companies were singled-out for significantly changing their business models by using digital technology, thereby enabling new growth and strengthening competitiveness.

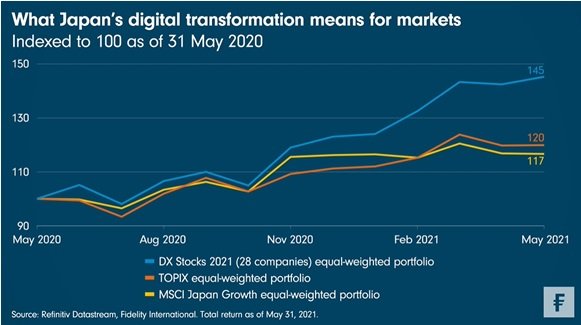

What does this mean for markets? This week’s Chart Room shows the 1-year performance of an equal-weighted portfolio in these 28 DX companies, versus an equal-weighted Topix portfolio. The DX companies have outperformed by 25 percentage points as of 31 May, 2021. Contrary to some impressions, DX is not just a proxy for growth factors. Data over the same period shows an equal-weighted portfolio of the stocks in the MSCI Japan Growth index actually underperformed the TOPIX stocks.

METI started focusing on DX in 2018, which for companies entails “establishing competitive advantages by leveraging data and digital technologies.” They have catching up to do: About 80 per cent of Japanese companies have aging technology infrastructures while 80 per cent of IT related expenses are used for the maintenance of existing systems, according to METI. As existing systems are becoming more outdated, complex and black-boxed, data cannot be fully utilised even if new digital technologies are introduced.

Spreading awareness

Over the past three years, awareness of DX or digital transformation has blossomed among both companies and investors in Japan. A keyword search of the financial statements of the more than 2,000 companies listed on the First Section of the Tokyo Stock Exchange shows the term DX was mentioned by 71 companies during March to May of 2019. This number jumped to 395 during the same period this year.

What’s more, these 395 companies have outperformed the other 1,795 First Section companies on average. Over the past 3 years, this outperformance was an impressive 16.1 percentage points as of 31 May. The total outperformance margin is similar - at 16.9 percentage points - if we extend the sample period to 5 years. This suggests that the stock market has been favoring companies with a DX strategy since the term was introduced in 2018, with the preference being negligible in the two years prior.

To the extent that DX capabilities lead to competitive advantages, it should be regarded as an important consideration in stock selection. In the longer term it remains to be seen whether, as Mr. Nishiyama’s book suggests, DX will prove to be the strongest strategy for reviving the Japanese economy - but for now it pays for investors to be decisive on this point.