J.P. Morgan: Markets expect two Fed hikes by the end of 2023

J.P. Morgan: Markets expect two Fed hikes by the end of 2023

The US economic outlook has improved substantially since the Federal Reserve (Fed) published their last forecasts three months ago.

Vaccine rollout is progressing at pace, and a huge stimulus package is adding to household savings that were already elevated thanks to the generosity of fiscal support last year. The Fed now expects that the US economy will grow by 6.5% in 2021. But while growth is likely to be strong as the economy reopens, how transitory any rise in inflation proves to be is uncertain, and so the markets’ focus on the Fed’s reaction to economic developments is likely to intensify and may lead to heightened volatility in Treasury markets. Investors can take comfort however, that should markets become disorderly then the Fed would likely take action to maintain favourable financial conditions and keep the economy on the path to full employment.

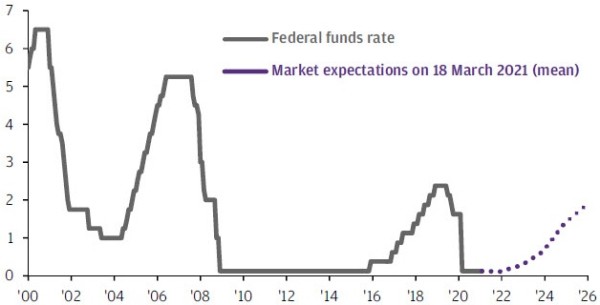

% Fed funds rate and market expectations

Source: Bloomberg, US Federal Reserve, J.P. Morgan Asset Management. Market expectations are calculated using OIS forwards. Data as of 18 March 2021.