BLI: Corporate debt: opportunities in a crisis

BLI: Corporate debt: opportunities in a crisis

By Jean-Albert Carnevali, Corporate Fixed Income Analyst

In recent months, the economic crisis that followed the health crisis and the lockdown measures has had a devastating effect on many businesses that depend on out-of-home consumer activity. However, despite the massive debt that businesses have amassed and the decline in consumer spending, the credit spread between corporate debt and so-called ‘risk-free’ rates has, within the space of five months, almost returned to pre-crisis levels, apart from cyclical and real estate securities.

Under the assumption of rational markets, this implies that, despite corporate indebtedness and weak economic activity, bond investors do not imagine the future being any worse than it was before the crisis. Furthermore, sovereign risk-free rates (the US and Germany) have reached historical lows, contributing to corporate bonds’ exceptional performance since April. This paradoxical situation has been encouraged by the massive interventions of the central banks and the fiscal stimulus measures put in place by various governments to support companies as best they can and boost consumption.

Monetary easing at the service of corporate issuers

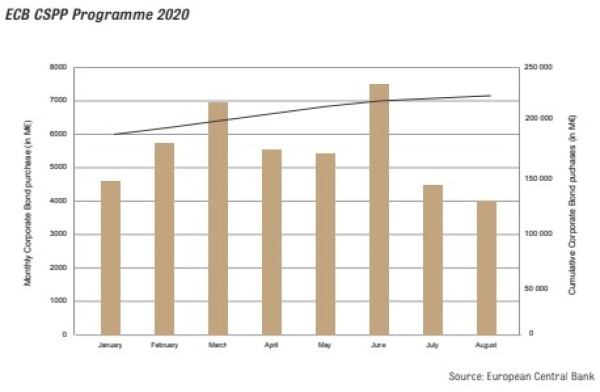

In Europe, the ECB has frozen interest rates in order to keep sovereign bond yields rock bottom. It has also increased its asset purchase programme for private and public sector securities (quantitative easing), especially for non-financial corporate bonds. As a result, it now holds more than 20% of the outstandings in the corporate bond universe eligible for its investment (eurozone ‘investment grade’ non-financial companies).

In the United States, the Federal Reserve has also implemented a bond buyback programme for riskier bond assets as well as drastically slashing interest rates (from 1.75% to 0.25% in March).

This accommodative context has enabled many companies to issue debt in order to (1) meet their need for liquidity and (2) refinance their activity at attractive rates.

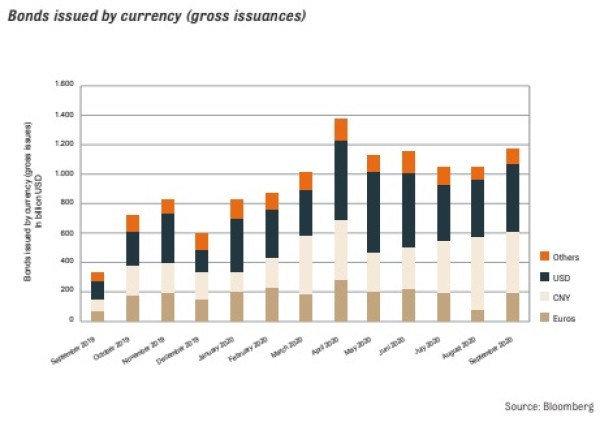

The graph below illustrates the corporate debt issued in one year.

The market for debt issued in euros was much less active compared to those in dollars and yuan. This is because there has been little change in European risk-free rates during the crisis (the ECB has not cut interest rates). However, there has been a higher level of euro-denominated issuance during the crisis in response to the liquidity stress facing companies.

Emerging market corporate bonds followed the tone set by those of developed countries. However, the monetary and fiscal policies of emerging market countries are different from those of developed countries as emerging markets have not embarked on such expansionary programmes.

Economic recovery: change of course?

The markets’ greater volatility in September was the consequence of a simple observation: drip-feeding corporate debt with cash will not be enough to beat the pandemic. The risk of a second wave has materialized in some regions and is looming over others. The V-shaped economic recovery is off-track and has lost momentum in developed countries. Consequently, regional and sector disparities are becoming more evident. The technology and e-commerce sectors have benefited from the crisis, accelerating their growth and increasing the dependency of end consumers. At the other end of the spectrum, cyclical sectors such as travel, retail and catering are in a precarious situation. To prop up their distressed operations, they need sufficient liquidity in the short term and robust solvency in the medium and longer term. The credit risk in these sectors is of course partly linked to the economic context, but it also includes a significant idiosyncratic risk linked to the company's balance sheet.

In the current context, it is difficult for traditional companies that depend on consumer presence to make projections for the future. This has a knock-on effect to the entire supply chain. Capital-intensive companies are forced to constrain their investments, pull out their assets early, and draw on their liquidity reserves to make up for their losses. Restructuring programmes follow suit to revise existing investment plans downwards and cut operating costs as much as possible, inevitably reducing the workforce. There are plenty of companies in this boat: Airbus, Boeing, Renault, BMW, Continental, Valéo, and Air France to name just a few.

Impact on investments in corporate debt

The impact of all these considerations on corporate debt market is manifold. Firstly, in developed countries, although the risk on short-term interest rates has been eliminated, the credit risk is increasingly present with the resurgence of localised lockdown measures that are stifling the stimuli to economic recovery. While in the short term, support from the central banks helps conceal this credit risk, in the medium and long term, the ability of companies to maintain their operations and, ultimately, their solvency, is threatened. Indigo Group is a case in point: this global car park operator is highly indebted (81% of its liabilities in fiscal 2019) with low EBTIDA in relation to interest charges and operations that are in difficulty due to the pandemic. A company's solvency is a key element to be taken into account when making an investment decision.

For emerging market securities, it is essential to carry out a fundamental analysis of the company in question in light of a higher interest rate risk and therefore a shorter investment horizon than that of the market. Despite historically low interest rates, some emerging market companies are maintaining significant returns due to higher remuneration for the credit risk than in developed countries. In terms of risk/reward, some attractive securities can be found in emerging markets. Moreover, the narrowing spread between US and European sovereign yields makes it possible to invest in emerging market issuers that only offer dollar-denominated issues by hedging the currency risk at an attractive rate. This is the case, for example, for Transelec and Colbun, operators in the Chilean electricity market, which offer attractive returns with robust financial profiles.

What about sustainability?

Environmental, social and governance (ESG) considerations are increasingly relevant nowadays and there is no doubt that tomorrow's companies will have to take this issue into account in their business model. We believe that ESG factors should be systematically considered when making investments, as they help to reduce a company’s inherent risk over the long term. The increased risk for private issuers following the health crisis has accelerated the significance of this theme with a view to reducing risk over the long term and focusing on convictions at both a financial and extra-financial level.

The concept of sustainability leaves plenty of room for interpretation due to the lack of an institutional standard. The European Union is in the process of creating a taxonomy as a tool to define the contribution of different sectors of activity to energy transition. However, there is still indecision with regard to the nuclear sector, which provides decarbonised energy in large quantities on the one hand, but on the other hand represents a threat from a security point of view. And what about controversial issuers such as Volkswagen that issue green bonds?

Although VW is seen as wayward in terms of ESG, it is trying to take a step towards a more sustainable manufacturing process and product through green financing (the production and marketing of electric vehicles contributes to the realisation of SDGs [1] 11 & 13). The company's current ESG situation should therefore be seen within the perspective of its future vision and the efforts it is pursuing to achieve this (through issuing green bonds, for example).

Outlook

After studying the global context over the last few months, we can highlight some observations on the general situation for corporate debt. Despite numerous concerns over prospects for businesses, there are nevertheless some certainties:

- The credit risk on a company's debt — and its remuneration — is a function of the probability of default and the loss incurred in the event of default. Fundamentally, this boils down to the company's ability to generate cash flow commensurate with its debt and inherent expenses. Generally speaking, the markets are underestimating this risk in the current weak economic climate since the general indebtedness of companies has increased while their ability to generate cash flow has not grown (in fact, quite the opposite). In these conditions, a correction will occur either when a company is not able to sustain its operations and/or when interest rates rise.

- The debt raised by companies to finance their growth is at risk in a recessionary environment. In this context, the preference should be for defensive sectors such as non-cyclical goods and utilities.

- Emerging market countries have higher growth potential than developed markets. In the current environment of economic contraction, emerging market companies that are fundamentally sound (financially and in ESG terms) may prove more resilient in the long term.

- The need for companies to transform their operations towards a more sustainable business model to meet current and future environmental and social challenges is much more than a passing trend. Businesses and investors are going to have to integrate this vital new reality into their future decisions so they are in tune with tomorrow's institutional standards and society’s goals. These considerations are having an impact on green bonds, which are already posting sustainability (‘greenium’) premiums over their traditional peers.

This prognosis underlines the importance of investing in corporate debt based on convictions pertaining to both financial fundamentals and sustainability principles.

[1] United Nations Sustainable Development Goals. For more information, refer to https://www.un.org/sustainabledevelopment/