Goldman Sachs: Revisiting the impact of trade policy on assets ahead of the US election

Goldman Sachs: Revisiting the impact of trade policy on assets ahead of the US election

The US election is moving into focus. As the US presidential election moves more clearly into investors' horizons, the potential shifts in international and trade policy under a Biden Administration have so far received less attention than the potential tax policy changes. In the analysis attached, Goldman Sachs’ market advisor Dominic Wilson considers the impacts of trade policy on various assets:

“A second Trump term would likely see some prospect of continued, and perhaps increased, fear of ongoing tariff increases, particularly given the deterioration in US-China relations over the course of the last few months. While a Biden presidency is unlikely to improve the outlook for the broader US-China relationship, it is less likely that a new administration would regard tariff threats as the ‘weapon of choice’, and might instead favor a more multilateral approach. At a minimum, we think the market would see lower risks of further tariff escalation and could price some probability of reversal further down the line.

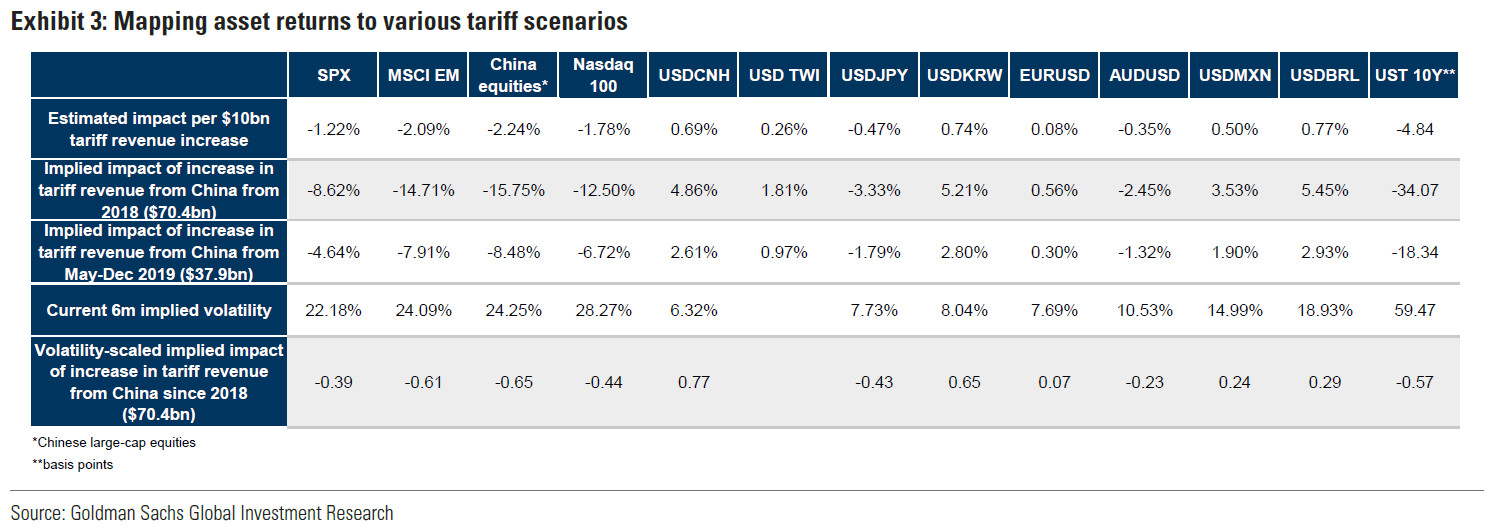

“Simple estimates of the distribution of outcomes suggest that there is a good chance that even if the differences for the two presidential candidates were limited to the removal of further trade risks, they could be of a similar order of magnitude as the scenarios laid out in Exhibit 3, particularly since we see some risk of tariff escalation against Europe as well under a second Trump term.”