JP Morgan AM: Average returns in election years are skewed by economic events

JP Morgan AM: Average returns in election years are skewed by economic events

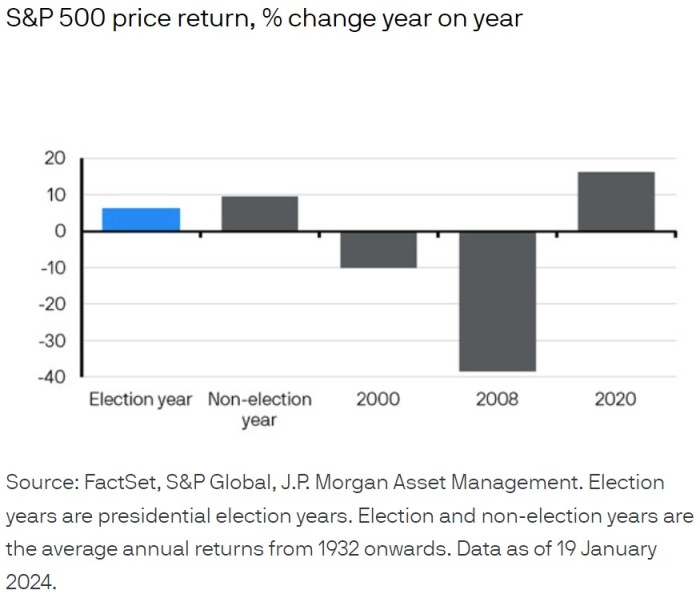

Last week, attention turned to the 2024 US election following former President Trump’s overwhelming victory in the Iowa caucus. But what exactly does an election year mean for markets?

Over the past 90 years, US election years have seen lower average returns and higher average volatility for the S&P 500 than in non-election years, yet it would be a mistake to think that this was purely down to politics. Election years have coincided with some of the most memorable market events in recent history, such as the bursting of the dot-com bubble in 2000, the financial crisis in 2008, and the Covid-19 pandemic in 2020. What is happening in the economy typically matters more for markets than what is happening at the polling stations.