AXA IM Alts: The role of natural capital to reach net zero

AXA IM Alts: The role of natural capital to reach net zero

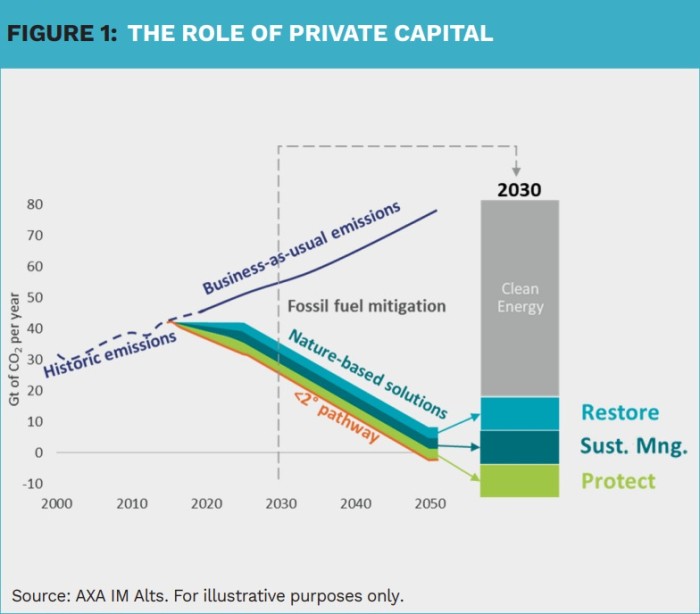

There is growing international consensus amongst companies and countries to cut their greenhouse gas emissions to net zero to tackle climate change whilst also reducing their impact on nature. We believe nature-based solutions play an important role in achieving this and that private capital will be needed to meet these ambitious targets.

By Adam Gibbon, Natural Capital Lead, Natural Capital & Impact Investments, and Jonathan Dean, Head of Impact Private Equity Fund Management, both at AXA IM Alts

Investments in nature-based solutions aim to reduce or remove greenhouse gas emissions through natural processes while delivering financial returns as well as biodiversity benefits. This form of investing recognises that natural capital provides a flow of valuable ecosystem goods or services that are beneficial in our everyday lives and for economic activity.

Investments in nature-based solutions today can often take the form of financing the creation of carbon credits or direct investments in sustainable forestry.

Carbon credits from nature

Nature-based emission reductions are usually generated via sequestration in growing trees or in the avoidance of deforestation and of forest degradation. When a project or a company generates emission reductions that are real (can be measured), additional (would not have happened without carbon finance), permanent (will endure for a long time), and don’t displace emissions elsewhere, they can generate carbon credits via two main mechanisms:

1) Voluntary carbon standards

Over the past 20 years, a number of organisations, such as VERRA’s Verified Carbon Standard (VCS), the Climate Action Reserve (CAR) and Gold Standard, have created voluntary carbon standards that allow project proponents to create and issue carbon credits according to their defined standards. New standards are also emerging. Voluntary carbon standards can be sold to organisations who have made voluntary commitments to reduce emissions on their own accord or as part of commitments, such as the Science Based Targets Initiative (SBTI).

2) Compliance carbon standards

At international, regional, and national levels there are cap and trade schemes that allow entities with regulated emissions to purchase offsets. An example is the California Air Resource Board, which allows certain nature-based credits from US projects. The French government’s ‘Label bas-carbone’ is an example of a government carbon credit certification scheme that credits tree planting and sustainable agriculture activities.

Returns beyond carbon credits

Sustainable forestry investments involve establishment and management of certified sustainable productive forest lands on previously degraded lands.

In parallel, a portion of the land under management is restored back to natural conditions. These investments have the potential to generate carbon credit returns alongside returns from their timber. Such investments will help to meet the increasing demand for sustainable materials in the forms of roundwood, bioenergy and pulp/paper, and take pressure of existing forests that are unsustainably harvested to meet demand.

An emerging opportunity is the potential for investment in natural capital to generate biodiversity credits that are awarded where biodiversity uplift or conservation can be demonstrated and verified by a third party.

To tackle the challenge of climate change and biodiversity loss, investments in natural capital should focus around three key themes:

1) Protection

By investing in the protection of eco-systems, such as rainforests or wetlands, their inherent value can be preserved in their current states and further degradation can be prevented. Such investments involve creating conservation with models that support local stakeholders.

2) Restoration

Restoration investments aim to recover and revitalise degraded ecosystems. This can involve activities like reforestation or rewetting drained peatlands. The goal is to bring these ecosystems back to a healthier state where they can once again provide their full range of benefits, both ecologically and economically.

3) Sustainable Management

Instead of exploiting natural resources to depletion, sustainable management ensures that they are utilised in a manner that is both economically viable and ecologically sustainable, thus harmonising human activities with nature’s limits. For instance, sustainable forestry practices would ensure logging is done without degrading the forest’s health, thus ensuring that it continues to provide value for generations to come.

The role of private capital

Climate change and the environment dominate the next decade’s global challenges, according to the World Economic Forum’s 2023 Global Risk Report. At the same time, over a million species are threatened with extinction globally due to the loss of their natural habitat1. Half of the global economy is ‘moderately or highly dependent’ on nature and its related services2. The growing global consensus, that the climate and biodiversity crises must be tackled, presents important opportunities for private capital to pivot towards models that boost rather than degrade natural capital.

The UN Environment Program forecasts that spending on climate and biodiversity needs to increase three times by 20303, from $ 154 billion per year today. Considering that today 84% of that spend comes from the public sector, it is clear that the dramatic increase needed will have to come largely from new private sources of capital.

It’s estimated that investments in natural capital can deliver one third of the climate change mitigation needed by 2030. As well as being the biggest single lever we have to reach net zero, natural capital also delivers emission reductions at the lowest cost4, making it a priority sector on the route to net zero.

In addition to tackling this generation’s greatest challenge, climate change, private capital can also play an important role in addressing the biodiversity crisis and contribute to reducing social inequalities.

3) https://wedocs.unep.org/bitstream/handle/20.500.11822/41333/state_finance_nature.pdf

4) https://www.ipcc.ch/report/ar6/wg3/figures/summary-for-policymakers/figure-spm-7/

|

SUMMARY Nature-based solutions will play an important role in achieving a net zero world. Investments in carbon credits aim to reduce or remove greenhouse gas emissions through natural processes, while at the same time delivering financial returns and biodiversity benefits. Investments in sustainable forestry aim to protect and restore ecosystems through, for example, reforestation and rewetting drained peatlands. The goal is to once again allow these ecosystems to provide their full range of benefits, both ecologically and economically. |

|

Source: AXA IM as of 31/07/2023. The information is estimated byAXAIM and is based on the investment team experience and current view of the market and is provided for illustrative purposes only. This marketing communication does not constitute, on the part of AXA Investment Managers Paris a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision. Due to its simplification, this communication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. Issued by AXA INVESTMENT MANAGERS PARIS, a company incorporated under the laws of France, having its registered office located at Tour Majunga– La Défense 9 –6, place de la Pyramide–92800 Puteaux, registered with the Nanterre Trade and Companies Register under number 353 534 506, and a Portfolio Management Company, holder of AMF approval no. GP 92-008, issued on 7 April1992. In other jurisdictions this document is issued byAXA Investment Mangers SA’s affiliates in those countries. |