JP Morgan AM: Attractive yields in EM debt are enticing investors

Post-pandemic, many emerging market (EM) economies have demonstrated impressive macro stability.

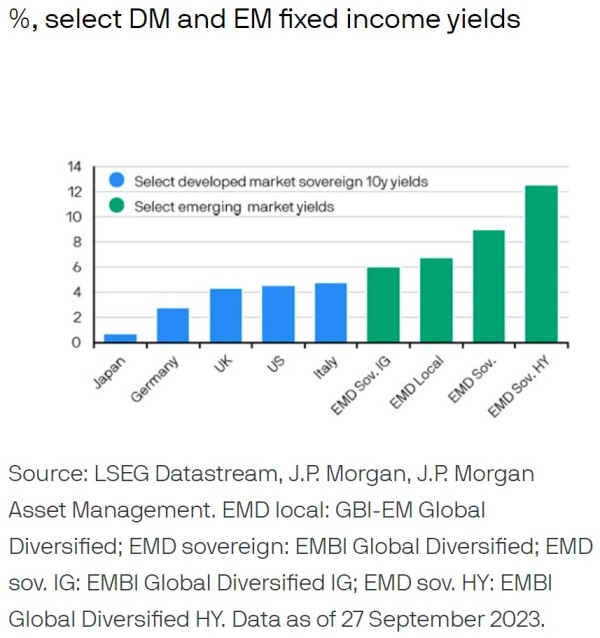

An earlier start to hiking cycles in EMs has helped inflation move lower, allowing EM local currency debt investors to benefit both from relatively higher yields as well as local currency appreciation.

More recently, the announcement of India’s inclusion in emerging market bond indices has added to investor interest. This inclusion should not only increase diversification but is also expected to enhance the index yield along with a modest increase in duration.

Looking ahead, as many EM central banks continue to see progress in their inflation fight, debt investors stand to benefit. With a growing number of EM central banks poised to cut policy rates ahead of developed market central banks, we see local currency EM debt as an important part of the fixed income toolkit.