Amundi: Developments in the emerging markets sovereign sustainable bond market

Amundi: Developments in the emerging markets sovereign sustainable bond market

The theme of this year’s IMF-World Bank Spring Meeting was ‘Reshaping Development’. The emphasis on supporting developing economies in a sustainable way could not have been more pronounced.

By Esther Law, Senior Portfolio Manager EMD and Responsible Investing Lead, Amundi

While there is a huge push for the sovereigns, especially among emerging markets (EM), to issue more sustain - able bonds, there are still challenges to overcome before the sustainable sovereign bond market can meaningfully take off. In this article, I am going to discuss why one should look at emerging market debt (EMD) as an investment opportunity now, the challenges and opportunities in the EM sovereign ESG space, and the power of engagement.

Emerging market debt as an investment opportunity

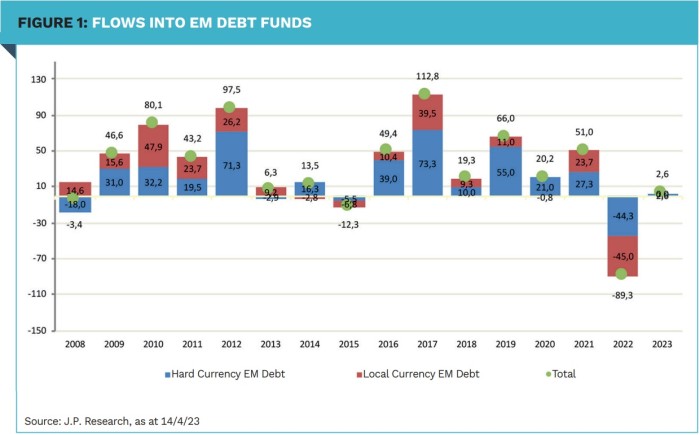

Despite the volatility in the EM universe, EMD remains an important asset class, given that 66% of global growth comes from EM countries. In comparison: only around 13% of the Bloomberg Global Aggregate Bond Index is emerging market debt. In addition, following the historically large outflow of nearly $ 90 billion in 2022 (see Figure 1), the positioning in EMD is now much clearer. This is especially the case in the local currency sovereign space.

With the end of the Federal Reserve interest rate hiking cycle in sight, EMD is very likely to benefit, especially the local currency government debt. This should yield positive performance both from the carry component as well as from the EMFX component with a potentially weaker USD view in the second half of 2023. As most EM central banks hiked their rates earlier, and more so than developed markets, the pause in the Fed hiking cycle does allow some of them to start easing as early as later this year, making local currency bonds more attractive.

Turning to EM sustainable bonds, use of proceeds green bonds is still by far the most developed type compared with social, sustainability, transition and sustainability-linked bonds (SLBs).

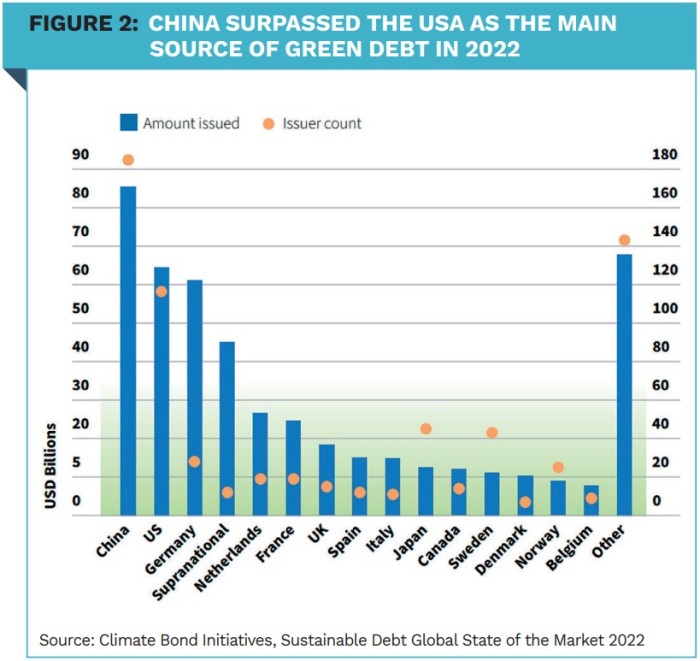

Although the pandemic and the Fed hiking environment have resulted in lower green bond issuance in general, especially last year, China overtook the US to become the top green bond issuing country in 2022 (see Figure 2). Since the pandemic, the issuance of social bonds increased, which helped with rebuilding the economy at a very daring time when many countries struggled with expanding social spending.

In 2022, although the overall issuance in EM sustainable debt was dented by the increase in global interest rates, green, social, sustainable and SLBs issuance reached a total of $ 83 billion among 26 EM countries, according to the Climate Bonds Initiative’s statistics. Many multi-development banks (MDBs) have played a big role in providing technical support for EM sovereigns in constructing their sustainable bond framework or SLBs, for example in Chile and Uruguay.

Challenges and opportunities in the EM sovereign ESG market

Compared with the EM corporate bond market, the EM sovereign sustainable bond market is definitely lagging behind. Several key factors can help to explain this: 1) there is still a lack of standardisation as to which ESG key performance indicators (KPIs) to use, 2) the quality of KPI reporting is very varied, with some EM sovereigns being very transparent while many others are still in the development phase, 3) social and governance standards are very difficult to quantify and track in some developing countries, 4) the lack of cost advantage (the so called greenium) for the sovereign to issue labelled bonds over conventional bonds, 5) the cost and technical difficulty in setting a sustainability or green bond framework, 6) lack of investor confidence in the quality of KPIs and reporting, and 7) the lack of consensus on the regulation front regarding definitions, especially around net-zero.

However, there have been plenty of efforts by the World Bank, Inter-America Development Bank, Asia Development Bank, other MDBs, Non-Governmental Organisations, private sector investor networks (such as the UN Principles for Responsible Investment) and EM sovereigns themselves trying to improve in these areas.

Recently, there have been some joint efforts between the private sector and public sector to help provide some assessment frameworks, such as the investor-led Assessing Sovereign Climate-related Opportunities and Risks (ASCOR) framework, which aims to provide an open-source set of climate KPIs to address the lack of standardisation of issues in the sovereign space. Better KPIs and standardisation in the sovereign universe would not only give investors confidence in investing in EM sovereign sustainable bonds (and thus facilitate transition into sustainable finance), but would also allow sovereign issuers to have a more standard set of KPIs for future labelled bond issuance.

The success of the USD Uruguay SLB maturing 2034 is a good example of how a well-structured SLB with reliable and aggressive KPIs (GHG emission reduction of NDC aligned -50%, and 100% forest conservation by 2025) successfully attracted new bond buyers and thus diversify opportunities for sovereign issuers to access the capital markets. The Uruguay Debt Management went all the way to set a more ambitious target of -52% GHG emission reduction and 103% forest conservation by 2025 to benefit from a coupon step down of 15bp.

The power of engagement

There is still a lot of work to be done, but the collaboration so far by various stakeholders, from the sovereign issuers themselves to MDBs, providing technical support, and eventually to investors, has definitely been encouraging. Engagement will continue to be key in improving the standard, the understanding and the quality of the KPIs and reporting, in order to safeguard against greenwashing. Engagement is also an effective tool for investors or regulators to let sovereign issuers know what disclosure is required. This is how to start bringing a good standard to the EM sovereign sustainable debt market.

Consistent and coherent collaboration between stakeholders is the most powerful force to tackle the current challenges and to turn those into opportunities in a sustainable way to help with achieving the 1.5°C pathway.

|

SUMMARY Although 66% of world global growth comes from EM countries, only 13% of the Bloomberg Global Aggregate Bond Index consists of EMD. The end of the Fed’s interest rate hiking cycle is likely to benefit EMD. China overtook the US as the top green bond issuing country in 2022. The EM sovereign sustainable bond market is still lagging compared to EM corporate bond market. The collaboration by various stakeholders to improve has been encouraging |