State Street SPDR ETFs: Position for Uncertainty in Global Equities

State Street SPDR ETFs: Position for Uncertainty in Global Equities

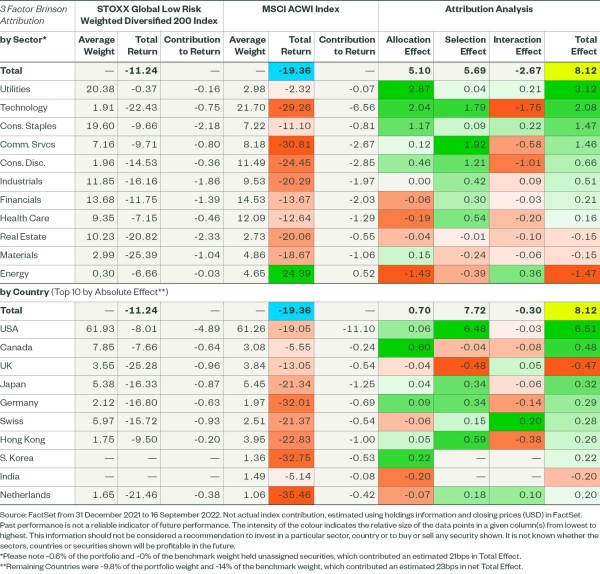

Global equities have experienced a significant drawdown in 2022, with the MSCI ACWI Index down 19% this year. The sectors that have experienced the strongest correction are the pro-growth technology (-29.26%), consumer discretionary (-24.45%) and communication services (-30.81%). Investors who took a defensive approach, such as through a global low volatility approach, would have benefitted meaningfully.

As Figure 1 illustrates, the STOXX Global Low Risk Weighted Diversified 200 Index has outperformed the MSCI ACWI by more than 8% year to date.

Figure 1: Brinson Attribution (Portfolio vs. Market Benchmark)

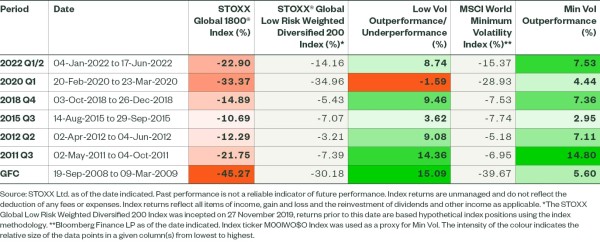

Global low volatility has not only benefitted from being underweight the hard hit pro-growth sectors, but it has also benefitted from its overweight positioning in utilities and consumer staples, which trail only the energy sector in terms of relative performance this year. The methodology behind global low volatility has also benefitted from stock selection in the industrials and financials sectors, as well as strong stock selection regionally in US equities. This type of defensive performance is expected from global low volatility, historically speaking (see Figure 2). In nearly every major market pull-back since the Global Financial Crisis (“GFC”), global low volatility has outperformed the market benchmark STOXX Global 1800® Index.

Figure 2: Global Low Volatility Performance in Major Market Sell-offs

Ryan Reardon, Senior Smart Beta Strategist at State Street SPDR ETFs:

“A low volatility approach allows investors to seek calmer waters. The performance of low volatility strategies in 2022 clearly demonstrates how (low) volatility factor investing can be a helpful tool to those looking for better risk-adjusted returns, given the magnitude of excess performance in down months is greater than the underperformance in up months, historically. Many investors and market commentators are warning about the risks that equity markets could extend losses in Q4 to end 2022. In the US, investors are concerned that high inflation and hawkish central bank policy could continue to have a negative impact on consumer behaviour and earnings expectations. In Europe, major concerns remain that the war in Ukraine will continue to disrupt energy supply from Russia to Western Europe at the time of year when colder temperatures significantly increase demand for energy. Winter is indeed coming.”