State Street SPDR ETF's: Ride out the volatility with convertible bonds

State Street SPDR ETF's: Ride out the volatility with convertible bonds

The return of inflation, together with more aggressive (or less accommodative) central bank policy, has pushed front yields higher and dented growth exposures significantly.

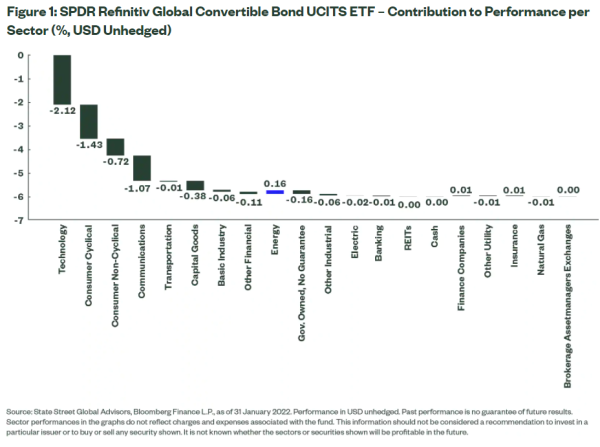

While convertible bonds traditionally have weathered such market rotations well, global convertible bond markets, as measured by the Refinitiv Qualified Global Convertible Index, had their worst start to a year since 2004, falling 5.81% in USD terms. The turbo-charged rotation to value, led by energy (2% of the index), left high growth sectors such as technology (27%), communications (12%) and consumer cyclical (20%) battered as markets grappled with still-rising inflation and an increasingly hawkish Fed. See Figure 1 for the full performance contribution breakdown.

In the last days of January, the index recovered partially from its lows. Energy was a key standout for the month as oil prices rose on geopolitical tensions and inflation numbers hit decade highs in developed regions. However, the weight of energy companies in convertible bond universes remains low and thus provided only a small positive contribution.

Valuations: lower deltas and a more balanced profile

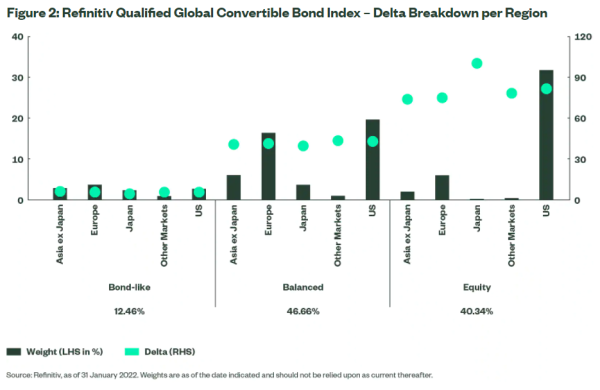

Delta, a measure of equity sensitivity, fell from 56% to 52% in January.

While the US remains a dominant portion of the global convertible bond index, the proportion of balanced and bond-like exposures has increased, offering more convexity to navigate the potential bouts of volatility ahead.

Looking ahead

While risk assets struggle to find direction and long-duration fixed income remains challenged by monetary tightening, convertible bonds should retain the benefits of lower rate sensitivity and their convexity profile, while also serving as a portfolio diversifier.

Convertible bonds also offer credit investors exposure to a set of issuers in high growth areas with only this type of debt on their balance sheets. However, some of these names – many rising stars of 2020 – have suffered since mid-November 2021 and, given the hawkish Fed pivot, their valuations may now look less rich. As the convertible offers an option on the underlying stock, upside participation is possible as share prices rebound on better earnings from these sectors.

Another important element for investors to consider, given the different pace of central bank rate increases, is the case for currency hedging. Once lift-off starts in the US, the USD could potentially weaken later in the second half of 2022 against the EUR (1.16 versus 1.14 currently) or the GBP (1.38/40 versus 1.36 currently), based on forecasts from Bloomberg.