SSGA-SPDR: Navigating higher US yields with EM hard currency debt

SSGA-SPDR: Navigating higher US yields with EM hard currency debt

While EM debt has faced challenges recently, we still see a rationale for continuing to include it in portfolios, most notably for risk diversification and yield enhancement. An allocation to EM hard currency can help to limit exposure to currency volatility and be used in conjunction with lower duration to reduce sensitivity to rising US Treasury yields.

The backdrop for EM hard currency debt

It has been a challenging quarter for emerging market (EM) debt. The risk-on rally, which kicked off in November 2020, underpinned gains that lasted into February 2021. While the reflation trade, on the back of a strong US growth rebound, has never receded in investors’ minds, EM debt has shifted into reverse.

Rising US Treasury yields, where the sell-off accelerated in February, appear to have been the kryptonite for EM debt. Historically low yields in EM debt and tight spreads to US Treasuries meant they were less able to absorb the impact of rising Treasury yields. Coupled with that, higher US yields dented the consensus that the USD would weaken further, hitting local currency funds. In addition, rising inflation pressures have prompted several central banks, notably Brazil, Turkey and Russia, to tighten policy despite the fairly unimpressive domestic growth backdrop.

Despite the setbacks, there remain some key reasons to continue to include EM debt in portfolios, most notably for risk diversification and yield enhancement. The sell-off has now reversed the fall in yields seen since last November, but stronger US growth should ultimately prove beneficial to emerging markets. We believe there are ways to invest while also limiting risk and offer the following 3 considerations.

1. Limit exposure to USD instability with EM hard currency

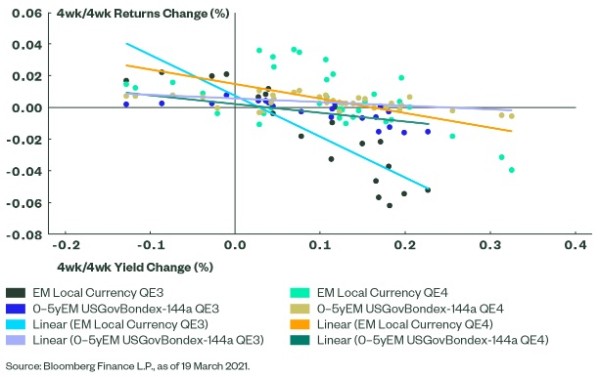

One of the key factors undermining EM debt returns has been the rebound in the USD, the flip side of which is local market currency weakness. The trend of USD weakness is expected to return at some stage but this is unlikely while US Treasury yields are rising, with the wider yield differentials supporting the USD. Opting for hard rather than local currency debt limits exposure to this currency instability. Figure 1 shows 4-week/4-week changes in EM debt returns against changes in yield during the latest sell-off and in QE3. This illustrates that the current sell-off is not as severe as the one that occurred during QE3. Furthermore, the relative flatness of the distribution of the hard currency returns suggests it is typically less sensitive to large rises in yields than local currency returns.

2. Lower duration to reduce sensitivity to US Treasury yields

We have written before on the virtues of lowering duration exposure in a rising yield environment in order to reduce sensitivity to rising US Treasury yields (see Get Shorty: Finding Opportunity in the Front of the Curve ). For instance, the ICE BofA 0-5 Year EM USD Government Bond ex-144a Index has just over 30% of the duration of the J.P. Morgan EMBI Global Diversified Sovereign Index. This does not always mean giving up returns: over the past 12 months, total returns for the ICE BofA 0-5 Year EM Index were 2.95% against just 0.91% for the J.P. Morgan Index. Over the longer term, returns from the longer duration index are higher but for the past 5 years average returns for the ICE BofA 0-5 Year EM Index have been at 60% of those of the J.P. Morgan Index.

3. Go for the pure play on the underlying issuers

Without the ‘shock absorber’ of a currency, hard currency funds are a purer play on the credit quality of the underlying issuers. While emerging markets will take longer to bounce back from COVID-19, given slower vaccination programs, stronger global growth should nonetheless be a positive on this front. Easier access to USD market funding usually also means a greater diversity of issuers. For instance, the ICE BofA 0-5 Year EM USD Government Bond ex-144a Index contains bonds from over 60 issuers against just 19 in the local currency J.P. Morgan GBI-EM Global Diversified Index.

How to play these themes

In summary, limiting duration and exposure to currency swings that have beset EM countries should reduce overall portfolio volatility, while still allowing investors to benefit from the relatively high yields on offer from EM debt strategies. For EUR-based investors who then want to remove USD risk, there are options with the SPDR® ICE BofA 0-5 Year EM USD Government Bond EUR Hdg UCITS ETF (Acc) hedged back to EUR.

Figure 1: Rapidly Rising US 10Y Yields Have Driven EM Returns Negative