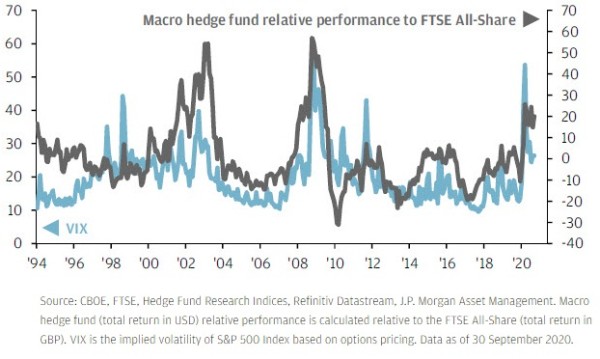

JP Morgan: Macro hedge funds have tended to outperform equities when volatility rises

JP Morgan: Macro hedge funds have tended to outperform equities when volatility rises

In the final quarter of this year, investors are likely to learn the answers to three pivotal questions for markets.

First, we are likely to hear the results of vaccine trials. Second, we will learn the results of the US election, which could have important policy implications, including the potential for further fiscal stimulus. Finally, we will see whether a deal can be reached between the UK and European Union. If the answer to any of these questions generates significant volatility, macro hedge funds have historically been a good source of diversification in portfolios. Meanwhile, if we get positive answers to all three questions, the most flexible macro strategies that can rapidly increase their equity exposure could then capture some of the likely resulting upside to equity markets while having buffered portfolios during this year’s volatility.

Index level (LHS); % change year on year (RHS)